credit is getting tighter

We traditionally see going into a recession, and during a recession, credit gets tighter. What is meant by hard loan for housing? This means some mortgage products may not be offered, FICO score requirements may be increased, and it may mean that pricing increases for some loans to account for the risk.

Thank you for reading this post, don't forget to subscribe!However, the current housing market is very different from the credit boom-and-bust cycle of 2002-2008, and it’s important to understand why.

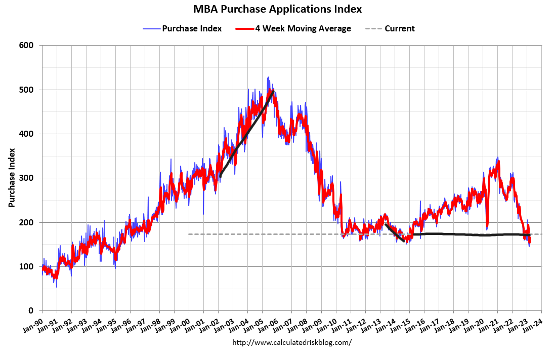

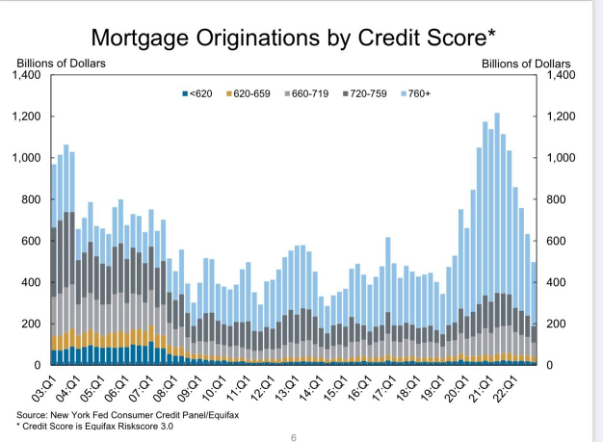

Credit availability was booming during the housing bubble years, then periodically collapsed. The MBA chart below shows just how big the collapse was at that point. Now, with new regulations since the financial crisis, the credit expansion and collapse will be a once-in-a-lifetime event.

Why is this so important? Over the years, a big point of my discussion has been that we didn’t have the massive credit housing boom in America during the past few years, nor can we ever have. Due to the qualified mortgage laws of 2010, we are lending to borrowing capacity, meaning that the speculative credit cycle from primary occupant homebuyers or even investors may not occur in the same fashion as 2002-2005.

The Shopping app data below shows this clearly. We had a lot of credit growth during the bubble years and not as much credit growth in the last few years.

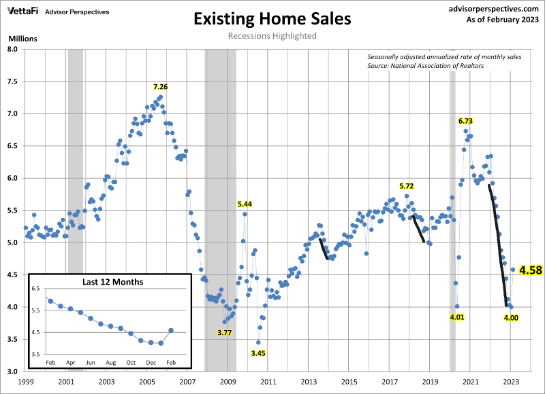

This is significant because the current home sales market was booming during its 2005 peak; The market needed loans to stay loose in order to keep demand high and growing. It is not so today. We had a huge drop in demand in 2022, not because credit was tightening, but because affordability was an issue.

Working from shallower levels, after the recent drop in rates, we saw one of the most significant monthly sales prints in history with the last existing home sales report.

This big jump in demand came from the waterfall dive, and we needed at least 12 weeks of positive, forward-looking data for this demand growth to happen, but mortgage rates fell. Mortgage lending can be tighter for jumbo loans, non-QM loans, and home equity lines, but in line with Freddie Mac and Fannie Mae loans in general, FHAAnd VA Debt should be stable during the next recession.

the spread is widening again

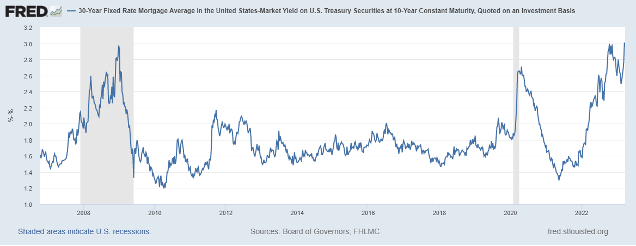

What has happened with the recent banking crisis is that the mortgage-backed securities market has become more stressed, so rates are higher than they should be as the spread between the 10-year yield and mortgage rates has widened again.

As you can see below, the spread became much wider during the period of the great financial crisis and the COVID-19 recession. is usually a 1.60% – 1.80% difference between the 10-year yield and the 30-year mortgage rate, but now we’re 3%,

The chart below tracks the tension in the mortgage-backed securities market: The wider the spread between the 10-year yield and the 30-year mortgage, the higher the line. This means that the dance partners are creating some space between each other, even while dancing.

federal Reserve The US doesn’t care about the housing market. The Fed is complaining that mortgage rates are returning to 6% and homebuyers may find their work tougher. The Fed will rush to save one bank, but won’t whisper a word to the entire housing market to improve the spread.

So, the risk here is that when we have a job-loss recession, spreads get worse, because the Federal Reserve doesn’t care. I generally think the Fed can help the economy, but with this Federal Reserve, you never know what they will and won’t do. i talked about it on wednesday cnbc,

We should keep this in mind in times of recession. No help may come to the housing market, even as we approach the one-year call on June 16, 2022, putting the housing market into recession.

Homeowner’s Balance Sheet Looks Amazing This Time

As I said above, credit hardening in relation to demand doesn’t matter because we didn’t have a massive credit boom from 2002-2005 to a credit crunch from 2005-2008.

The mortgage market may be stressed as spreads may widen, meaning interest rates may be higher than in normal times. However, we are not going to see credit availability shrink in the same way as in 2008.

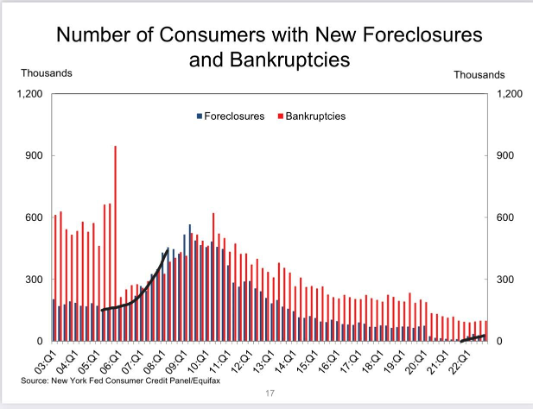

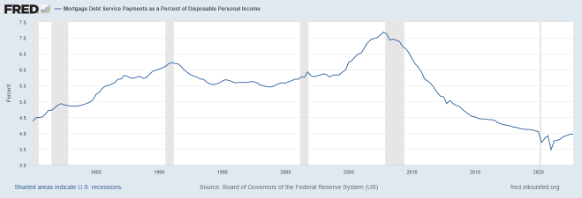

The most important difference between 2008 and the previous 13 years after the qualified mortgage laws were enacted is that we do not see the increase in housing credit stress prior to the job-loss recession. If there’s one chart I’ll show every day, it’s the one below: Housing credit stress was easy to spot years before the job-loss recession. Today it is very easy to see that we do not have the same credit stress as homeowners.

Because the US no longer has a foreign debt debt structure, we don’t have massive exposure to homeowners and banks. Over time, foreclosure data should be closer to pre-COVID-19 levels, but nothing like the credit stress seen from 2003-2008.

The landlord’s financial data looks great; Fixed loan costs, rising wages and cash flows look better and better over time. As you can see below, mortgage debt service payments as a percentage of disposable personal income look excellent, much better than they did in 2008.

That means cash flow is looking great! Do you want to know why people are not leaving the house? A US home with a 30 year fixed mortgage is the best defense on planet earth. As inflation comes down, homeowners’ cash flow improves. During periods of inflation, your salary increases faster, but as a homeowner, your loan cost remains the same.

Unlike in 2008, we do not have a significant risk of loans being restructured with payments that the homeowner cannot afford, even if they are still working. We’ll see an increase in 30-day delinquencies, and in 9-12 months, we’ll see the foreclosure process work. However, in terms of scale, nothing like what we saw in 2008.

Hopefully, this gives you three different credit on credit questions when we go into a recession.

Credit tightening is not a significant risk with respect to most loans being made today because government agencies back most loans made in the U.S. However, the mortgage-backed securities market has been under stress for longer than most people imagine. Maybe when the next recession hits.

We do not increase foreclosures as we did from 2005-2008 before the job-loss recession. However, we do have traditional risk, which means homebuyers with smaller down payments may be at foreclosure risk in the future if they lose their jobs.

So, we have a different economic background now compared to 2008 and 2020. The two recessions were very different from each other, but it gives you an idea of some important dynamics around housing loans, credit and risk as we head into the next recession. ,

As always, we’ll take the data one day, week and month at a time and walk this path together.