This article was brought to you by Rent to Retirement. Read our Editorial Guidelines for more information.

Selecting the right real estate investment to add to your portfolio requires ample research and extensive knowledge about the market you are investing in. One bad decision can result in a significant drop in the value of your portfolio. When markets begin to decline and the economy enters a recession, choosing the best investments becomes even more important.

The most profitable investments are those in recession-proof markets, which are areas with high demand for homes regardless of how the economy is performing. Not every market performs in the same way. By investing your money in homes that are located in recession-proof markets, you can take advantage of consistent rental income, moderate appreciation even in poor economic environments, and continued rental growth.

Why now is a good time to invest

Recent market trends indicate that 2023 is a good time to invest in real estate as long as you focus on the right markets. In recent months, interest rates have continued to rise. However, this growth has slowed down and may level off by the end of this year. Buyer demand is also falling, making it easier for you to invest in real estate without needing to place multiple bids before accepting one.

While the current state of the economy is adversely affecting the real estate market as a whole, there are some individual markets that appear to be recession-proof, meaning they will continue to do well in comparison to the national housing market.

When identifying markets that are considered recession-proof, there are many factors that must be considered, including everything from average selling prices to population numbers. The following provides a comprehensive overview of five of the top recession-proof markets in which you can invest throughout 2023.

Kansas City, Missouri

As the largest city in Missouri, Kansas City has long been a popular destination among residents of California as well as those visiting from other large Midwest cities. there are many pieces of data and statistics This points to Kansas City being recession-proof. For example, the average selling price in the city continues to rise, meaning buyer demand is not slowing down, as it is in cities and towns that are not recession-proof.

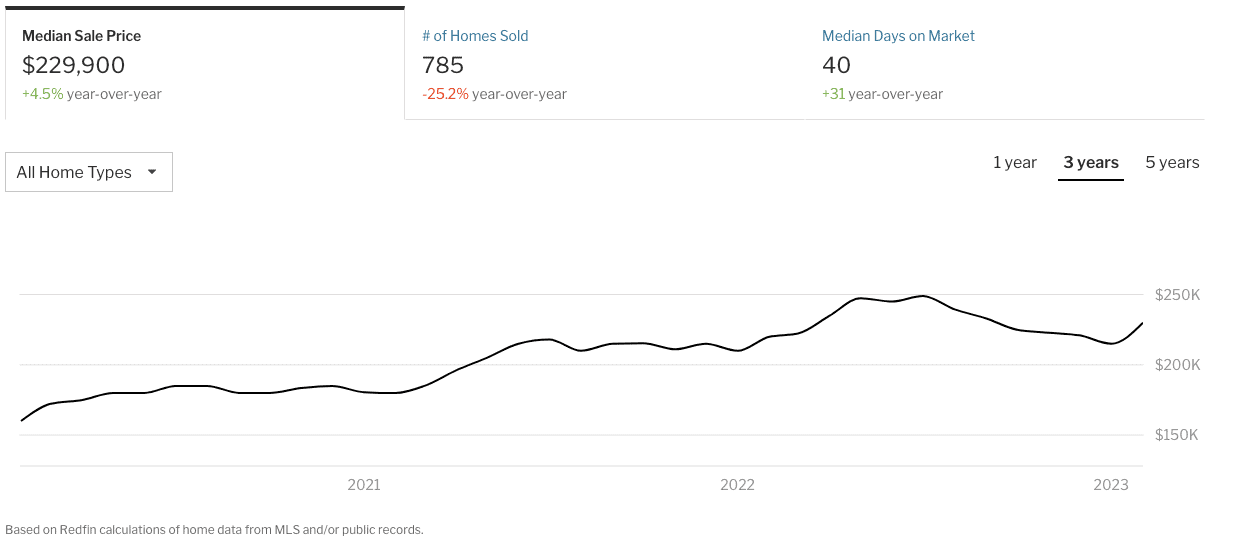

In every real estate market, home prices typically reach their highest levels in the late spring and summer months before dipping slightly in the winter months, when not many buyers are in the market. While this is also the case in Kansas City, the median sale price has been trending higher for a longer period. The average sale price is $230,000 by 2023, an annual increase of about 7%. In June 2022, the average sale price was $285,000.

In the coming months, home values in Kansas City should increase as there are no signs that the current economic climate is affecting the local real estate market. Even though homes have become more expensive in Kansas City, the median price of $230,000 is highly affordable compared to many popular markets across the United States. Even if you are able to buy property at an affordable price.

Over 400 homes sold in this market in January 2023. Home sales typically approach 1,000 per month during the hot summer months. Over the years, home sales in the city have been relatively stable, which means that the best time of year to invest largely depends on the type of property you are buying and how much competition you are facing. are ready for. ,

Keep in mind that January 2023 saw a price drop of 28% of homes on the market, which was an 11% year-over-year increase. In this scenario, you have some negotiating power while trying to get a lower selling price. Over the past decade, Kansas City’s population numbers have grown steadily. The current population is over 500,000 and has increased by over 50,000 since 2010. If you are going to rent out your investment property, you can be sure that a large number of people will be looking to rent.

Akron, Ohio

Akron is another popular Midwest city with affordable home prices that investors can take advantage of. the current average selling price It’s just under $107,000, which is close to the price at this time last year. While home prices in most cities typically peak in June and July, home prices in Akron are set to match June highs in September 2022.

Another sign that Akron is a recession-proof real estate market is that the number of days homes have been on the market before selling has been consistent. In January 2022, homes were on the market for an average of 33 days before being sold. After one year, homes are on the market for an average of 34 days before being sold.

When downturns occur in markets that are not recession-proof, it is common for buyer demand to drop significantly, causing home inventory to stay on the market longer than usual. Even in times of recession, Akron’s real estate market has almost maintained its performance when interest rates were at their lowest.

Lehigh Acres, Florida

of Lehigh Acres Strongest real estate market Ideal for anyone looking to invest in real estate in the US and during 2023. Perhaps the clearest sign that the Lehigh Acres real estate market is doing well is the median sale price of over $327,000, up nearly 25%. Average selling price in Jan 2022.

Even though home values are typically lowest in January, the average home price in Lehigh Acres has been slightly higher in July, August, and October of the past year. Home values have increased significantly over the past decade. In January 2018, the median sale price for a home in this city was $165,000, which means it’s almost double the current sale price.

If you are looking to invest in real estate that will provide you with a steady income, then the home you are investing in will appreciate in value over time due to the overall health of the Lehigh Acres market.

Keep in mind that the city’s population has grown significantly over the past decade and is likely to continue to do so in the years to come. In 2011, Lehigh Acres was home to a population of approximately 92,000. The total population has increased every year and now it is situated just under 125,000. As an investor, more people coming to town should make it easier for you to find tenants and keep rents high.

Indianapolis, Indiana

Indianapolis is another popular real estate market affordable home prices, As of January 2023, the median sales price for a single-family home in Indianapolis is $215,000, representing annual growth of approximately 1.5%. In fact, there hasn’t yet been a month without a year-over-year increase in home values in four years.

Five years ago, the median sale price for a home was a little over $136,000. By investing in the Indianapolis real estate market, you can have peace of mind that your property will appreciate in value over time. Homes only remain on the market for an average of 33 days before being sold, which indicates that there are many buyers and renters on the market. Buyers who can’t afford to buy a home because of the recession are more likely to rent, which means you should be able to bring on new tenants without a problem.

While all the homes are being sold relatively quickly, homes in popular areas of the city go from being listed to pending in just seven days. Like the other cities on this list, the population of Indianapolis has been growing steadily over the past decade. In 2013, approximately 844,000 people were living in Indianapolis.

Today’s population is over 900,000 Taking into account the current estimates.

Another sign that the market is recession-proof is the expected job growth in the city. The average rate of employment growth across Indiana in 2023 and 2024 is approximately 2%. In comparison, Indianapolis is expected to see employment growth of 2.9% for the same two years. Job growth means more people will come to town and want to rent.

Birmingham, Alabama

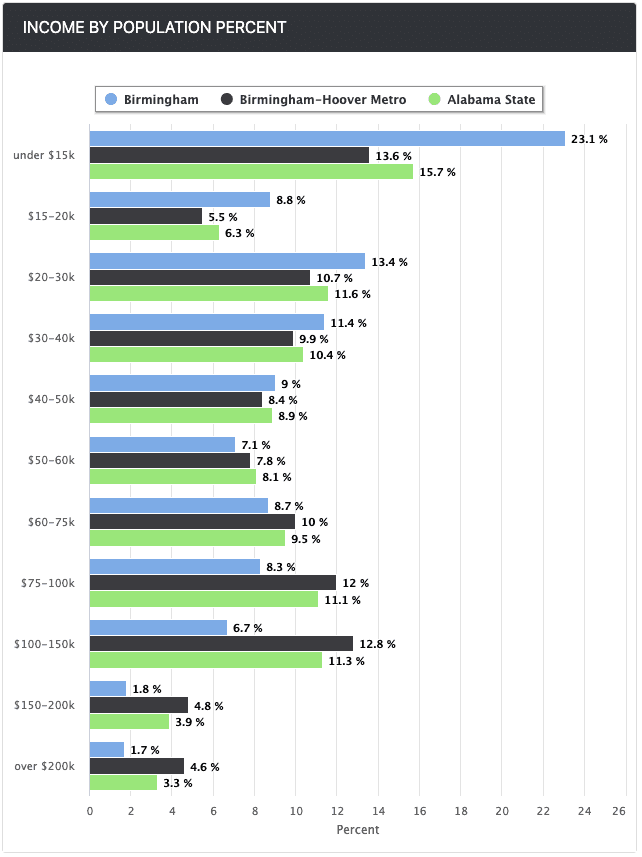

If you are looking to invest in a popular real estate market Which also has affordable homes, Birmingham could be the right place to look. The median sales price for a single-family home in December 2022 was less than $210,000, marking a 20.7% increase from the same month in 2021. you catch it

Keep in mind that real estate is often considered a hedge against inflation. At times when other investments decline in value, real estate values typically increase. You can also maintain a higher income in a recession-proof market because of your ability to charge consistent rents.

average fare A one bedroom apartment in Birmingham is $1,298 as of February 2023, a sharp increase of 27%. With this information in mind, you have the opportunity to buy property at a lower price and rent the property at a price that is much higher than the monthly mortgage.

One of the reasons Birmingham is a recession-proof market is the steady growth of employment in the city. The city has fallen in the last year job growth of about 2%, Recent estimates suggest that job growth in the city should be around 29% during the next decade. Investing in a city with high job growth means you should be able to avoid tenancy issues. A hot job market usually indicates that the real estate market will also be popular.

conclusion

Real estate is one type of investment that doesn’t need to stop you from adding to your portfolio when a recession hits. During bad economic times, you may be able to keep your income high and minimize portfolio losses by investing in markets that are considered recession-proof.

The above five markets have proved to be popular destinations among the buyers. When you invest in one of these markets, there is a possibility that the value of your asset will continue to increase the longer you hold it.

This article was brought to you by Rent to Retirement

Rent To Retirement is the nation’s leading turnkey investment company offering passive income rental properties in the best markets across America to maximize cash flow and appreciation! Rent to Retire is your partner in achieving financial independence and early retirement through real estate investing. Invest in the best markets today with an extensive team that handles everything for you!

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.