2023 will be tough for the housing market, but not the worst National Association of Realtors (NAR),

The annual Real Estate Forecast Summit, organized by NAR, gave its verdict on 2023 late last year. prognosisput together by Lawrence Yun, chief economist at NAR, can be summarized as a slow year for home sellers. While no immediate collapse of the housing market is expected, all current trends point to a decline in sales and slower growth in home prices in most areas.

Having said that, Yoon identifies several emerging housing markets that will experience price increases in 2023, as Austin and other cities did during the pandemic.

Home sales will continue to decline

The most significant prediction is that home sales will continue to decline in 2023. 2022, which will likely continue. Existing home sales fell 16% during 2022 and are now at their lowest level since 2014.

new housing starts Some are doing better and trading around their historical averages. The market for new housing survived its worst crisis since the 2008 financial crash, leading to a slow but steady recovery over the past decade.

The slowing of this segment of the housing market over the next year is representative of an overall declining trend, but, as Yun points out, “new home sales are doing better than existing home sales because new home sales during foreclosures have increased.” actually declined during the crisis and never fully recovered from it, and so they had a low base of reference to compare against.

Home price growth will be flatline or decline

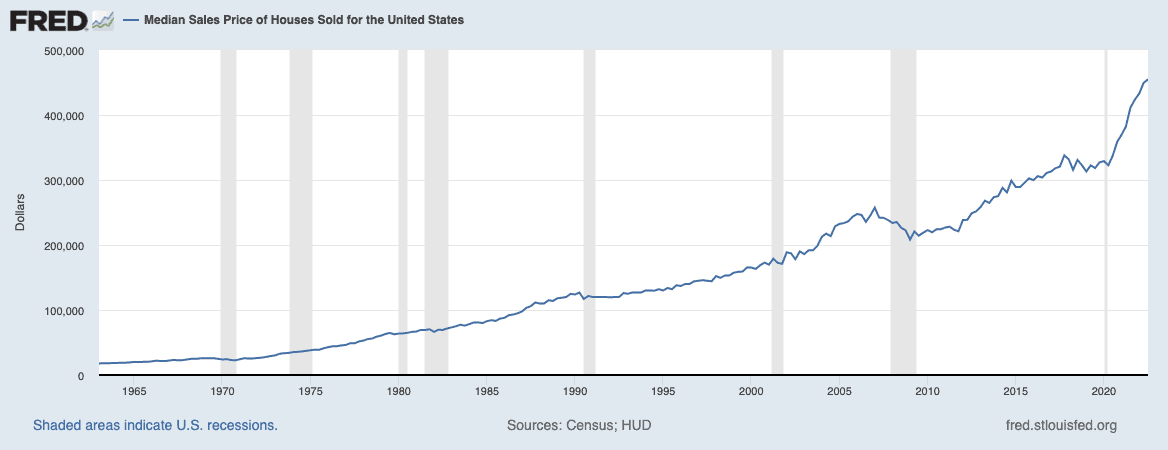

Home price growth is expected to flatline in 2023, officially ending the Covid price boom. Current forecast is an average only 0.3% increase At the median home value of approximately $455,000. What this actually means is that the housing market is still growing slowly.

According to NAR, we have avoided a large-scale accident or a near crisis. The job market has proved strong, some markets have held their ground on price, and inflation has begun to decline. Yun explains that “there are some layoffs in the mortgage industry today and maybe the technology industry has stopped hiring people, but if you look on the net, there are still job creation opportunities out there.”

The other lifeline that has averted the crash is the mortgage market. It’s safe to say that the tightening of lending regulations following the 2008 subprime mortgage crisis has made the housing market more resilient. “Subprime mortgages, those shady, risky, self-reporting mortgages, were widely prevalent during the last cycle. This time, people have to meet new regulations, so we don’t have those risky mortgages”, Yoon said. Said. NAR also predicts Mortgage rates will fall below 6% sometime during the third quarter of 2023 and will remain there through the end of the year.

Lastly, the supply-demand gap will not be able to be bridged anytime soon. This means buyer demand will continue to prop up the market for several months to come, keeping home prices stable in most areas, unless you’re in California, which sees home price increases of 10-15%. is predicted to experience a significant decline in

Next Austin?

NAR points to the following metros as the housing market hotspots of 2023:

- Atlanta, Georgia

- Raleigh, North Carolina

- Dallas-Fort Worth, Texas

- Fayetteville-Springdale-Rogers, Arkansas-Missouri

- Greenville, South Carolina

- Charleston, South Carolina

- Huntsville, Alabama

- Jacksonville, Florida

- San Antonio, Texas

- Knoxville, Tennessee

The South will lead the way in 2023. According to Yoon, “Southern states, generally speaking, meet the criteria for reasonable affordability, migration, and high-paying jobs.”

Real estate investors should take note of this trend if they want to capitalize on these market opportunities before they inevitably become oversaturated, as has been the case with Austin.

Find an agent in minutes

Get matched with an investor-friendly real estate agent who can help you find, analyze, and close your next deal.

- Streamline your search.

- Tap In a trusted network.

- Leveraged market and strategy expertise.

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.