The chart below shows the number of active listings since 1982:

The people who told you the demographics in America are terrible and we resemble Japan were drinking some mighty saki. For years, people said that slowing US population growth would mean we’d become Japan, but I’ve focused on the demographics and how that will affect housing from 2020-2024. With respect to the housing economics demand curve, it is always about the net number of people living and working.

In reality, housing economic modeling takes a lot of work, and some people instead choose marketing gimmicks to make a name for themselves. It’s very sexy to talk gloom and doom about the housing market, but sometimes it doesn’t end well. I am highly skeptical of stock traders when they talk about housing economics.

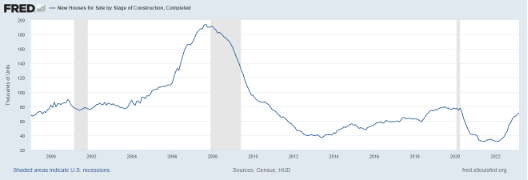

And here’s a case in point: New home sales took a big beating to estimates on Tuesday, but the real story is about supply and demand.

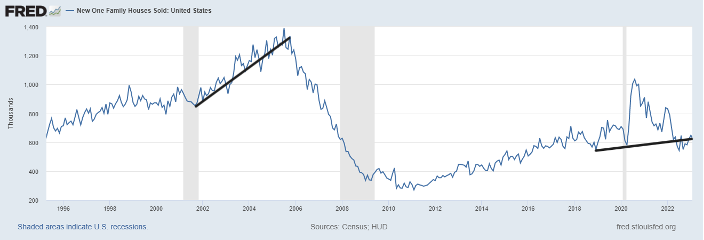

new home sales

From the Census: According to projections released today jointly by the U.S. Census Bureau and the Department of Housing and Urban Development, sales of new single-family homes in March 2023 were at a seasonally adjusted annual rate of 683,000. This is up 9.6 percent (±15.2 percent)* from the revised February rate of 623,000, but down 3.4 percent (±12.7 percent)* from the March 2022 estimate of 707,000.

As we can see in the chart below, it is not as if the new home sales market is booming; We are not even near the top of sales in 2005 or 2020. However, what has happened is that the housing data has stagnated.

When did all this happen? The forward-looking housing data started improving from November 9, 2022 along with the purchase application data and was ignored by almost everyone. The thing is, builders have time to work off their backlog of homes because they’re skilled sellers—they can cut prices, lower mortgage rates, and do whatever they have to to sell their product. He can, which is an object for him. They do not have the same issues as the current homeowner because they are not living in the home they are selling.

new home monthly supplywhy

The seasonally-adjusted estimate of new homes for sale at the end of March was 432,000, accounting for sales inventory and months’ supply. This represents 7.6 months’ supply at the current selling rate.

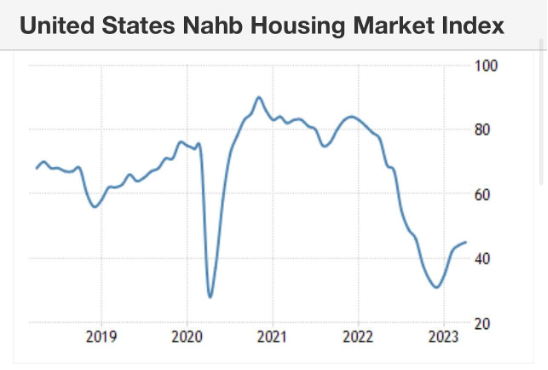

Builders are making progress here; Their confidence gets the better of them as the monthly supply falls. Context is always important with all housing data, and we did a waterfall dive into several housing data lines and bounced off that deep dive.

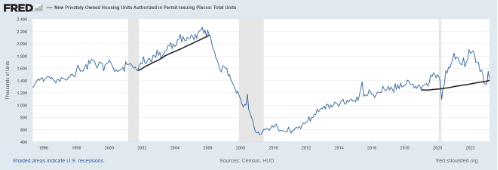

However, the housing market is still not strong enough to issue new housing permits. Only then will you know when the housing recession is out, and when builders can start building again. It’s that simple.

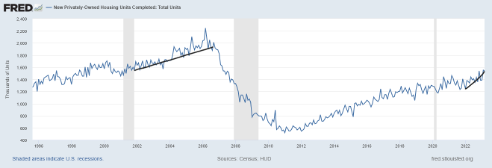

The data below is a significant improvement for builders, as housing completions are still rising while their monthly supply is falling.

I have a straightforward model of when homebuilders will start issuing new permits with some kick and duration. My rule of thumb for estimating builder behavior is based on a three month supply average. Not related to the existing home sales market – this monthly supply data applies only to the new home sales market and the existing home sales market 7.6 months There’s too much for builders to issue new permits with any natural steam.

- when supplies 4.3 In the down months and up, this is an excellent market for builders.

- when supplies 4.4 to 6.4 month, it’s a fine maker’s market. They will build as long as sales of new homes are increasing.

- when supplies 6.5 For months and more, builders would pull back on construction.

So, as we can see below, homebuilders are no longer dealing with spiking supply data, but a slowing downtrend still needs a lot of work to do. However, there is much more to this active listing story than meets the eye.

A 7.6 month supply breaks down like this.

- 267,000 The houses are still under construction. 4.7 months Compensated

- 94,000 The houses still need to start construction. 1.7 months Compensated

- 71,000 Has completed homes for sale. 1.2 months Compensated

No, I am not kidding you; Some people are talking about a massive increase in supply 71,000, We’re a long way from the peak of supply during the housing bubble crash, which was close 200,000.

Overall, Tuesday’s new home sales report is in line with new home sales data from several months back. Builders are doing whatever they can to move their product, taking advantage of the low total housing inventory, and are being helped by paying mortgage rates for their buyers. Imagine what the overall housing market would look like if mortgage rates were 5% Today.

As part of the Housing Market Tracker, we watch seasonal inventory weekly, and the expectation is that the seasonal inventory bottom has already happened, as I talk about here.

In regards to Wall Street’s surprise at the new home sales territory, was it really a surprise? Somebody had to buy builder stock, right? The reality is that home sales crashed last year and that hasn’t created the inventory that some housing experts were looking for last year and this year. This is where it helps to understand how credit channels affect housing inventory.

Hopefully, my work as HousingWire’s housing analyst has shed some light on this discussion, and it will come into greater focus when the next recession hits. By then, however, housing market tracker data outpaced this stabilization in new home sales data, and that shouldn’t have surprised Wall Street.