It had to happen, and finally it did.

as of last month a new report From the National Association of Realtors (NAR), real estate prices eventually turned negative,

“Median existing-home prices for all housing types were $363,000 in February, a 0.2% decline from February 2022 ($363,700), as prices climbed in the Midwest and South, yet decreased in the Northeast and West. This ends a streak of 131 consecutive months of year-over-year gains, the longest on record.

All good things, isn’t it? Although at first it may seem strange. I myself wrote back in september Last year, prices finally started coming down. But those were month-to-month prices. In normal times, even when the market is flat, prices tend to increase in the summer months and decrease in the winter months.

However, over the past few years, real estate prices have been on an almost straight upward trajectory, leaving the normal seasonal cycle in the dust. That trend ended last year. But the more closely monitored year-over-year price index was still up, despite the decline in monthly prices. Now, for the first time since the bottom of the Great Recession, year-over-year prices have declined.

The average price of a house in February 2023 is slightly lower than in February 2022.

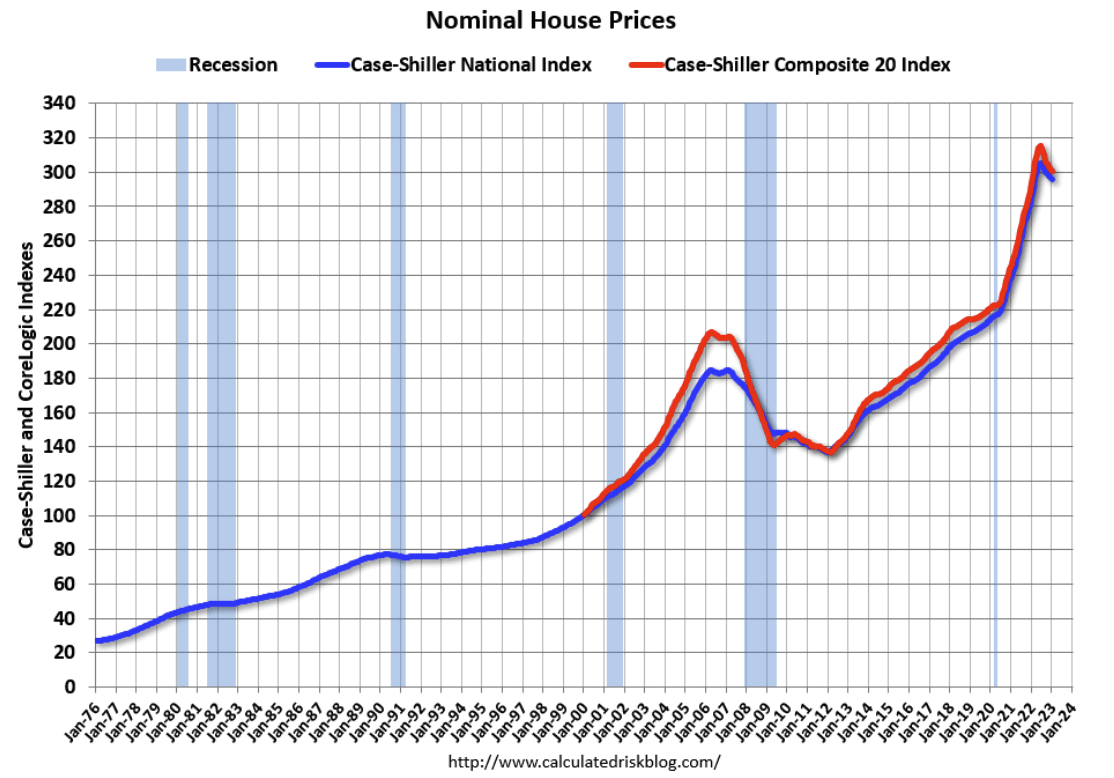

Of course, 0.2% (or $700) is nothing to lose your head over. Especially when you look at the overall trend, that last, minor downside is the current “housing crash”.

However, it should be noted that this is in modest prices. When inflation is taken into account, the prices are down a bit. as Bill McBride notes,

“In real terms (using the CPI low shelter), the national index is down 4.6% from its recent peak, and the composite 20 index is down 6.3% from its recent peak in 2022.”

strangely though month-to-month basis, prices actually rose in February for the first time since the middle of last year. After falling for seven straight months from its June 2022 high of $413,800, prices rose from $361,200 in January to $363,700 in February.

Still, it’s important to remember that, all things being equal, prices tend to fall in the winter and rise in the summer. So, this is likely a seasonal variation at play here. Still, it could be a sign that the housing market is starting to stabilize, despite higher rates. But, even if prices remain stable through the summer, this would mark a drop of more than 12% by the time June is reached.

sponsored

Fewer listings to buy in the housing market

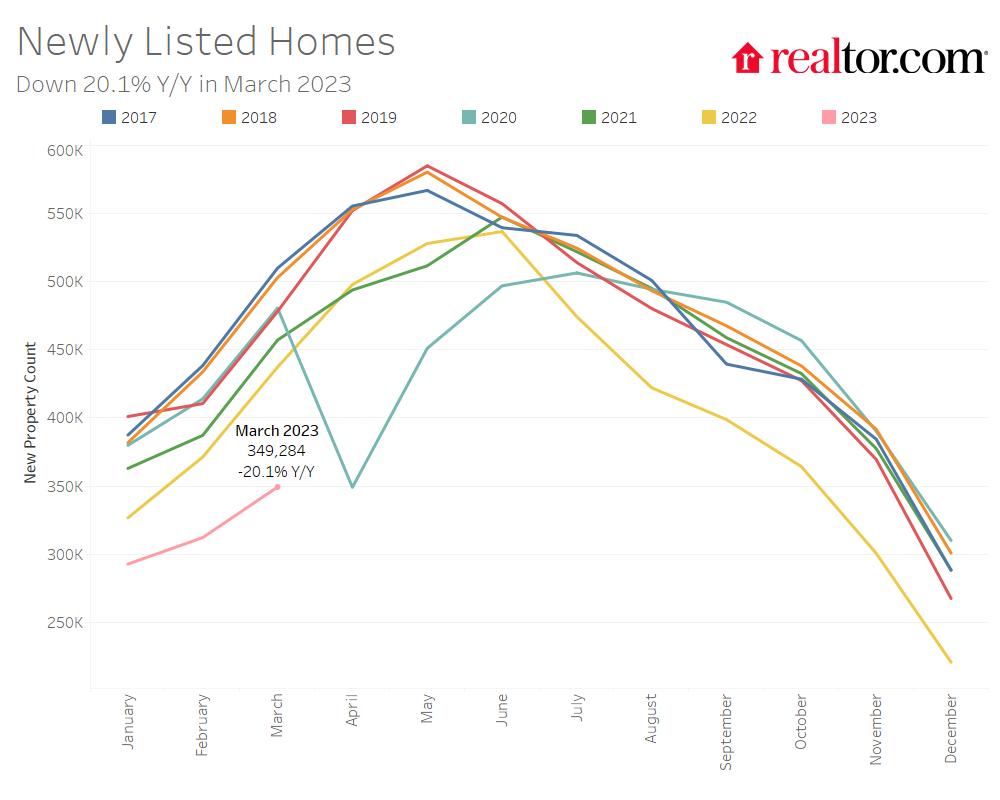

As I have noted beforeCompared to last year, significantly fewer people are listing their homes, reducing supply and thus causing housing prices to skyrocket. As Luck tells,

“…only 349,294 US homes were listed for sale in March 2023. That’s down from the 437,270 listed in March 2022 – a period infamous for its tight supply – and down significantly from the 478,100 listed in March 2019 “

They are a decline of 20.2% and 27% respectively. nothing to scoff at.

While listings for February were up compared to January (again, remember seasonality), new listings still far behind over the years (with the obvious exception of the first Covid outbreaks in March and April 2020).

Inventory is still up even though listings are down 15.3% YoY It ticked back up last month, though, due to declining sales. February supply stands at 2.6 months compared to 2.9 months for January. Oddly, it’s still considered a seller’s market. Typically, six months is considered a balanced market, although it’s been a long time since we’ve seen it. In my humble opinion, four or five should be considered balanced.

where things are likely to go from here

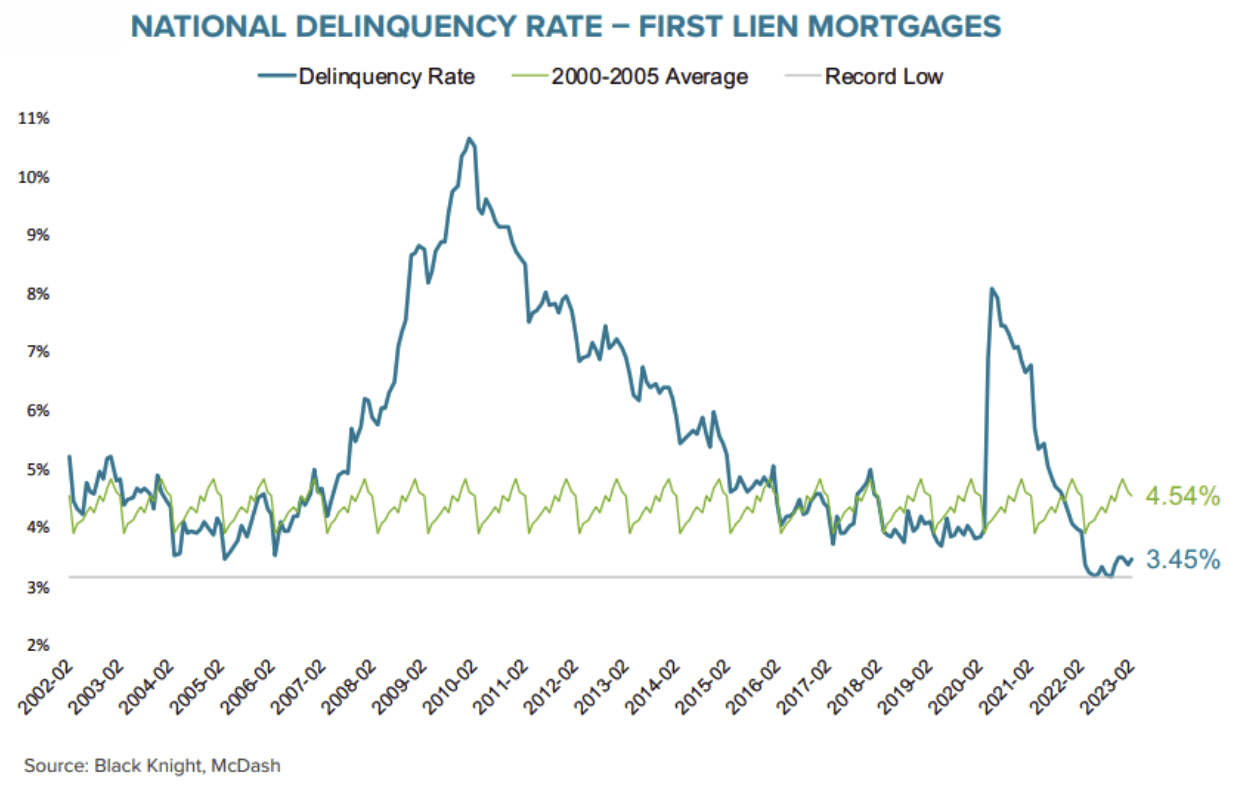

Housing collapses all but a large number of crimes and foreclosures are required. The same happened in 2008. However, today, most homeowners are sitting on fixed, low-interest loans, such a collapse is unlikely, After all, why sell if you have a 3% mortgage?

And as following chart From Black Knight’s Hostage Monitor Explains, mortgage delinquencies are still near record lows.

Aside from a short-term spike in the arrival of COVID-19 and subsequent lockdowns, crime rates have remained fairly low since the end of the Great Recession. And right now, they’re running a full 1% below their 2000-2005 average.

The only things that could cause a sizable increase in delinquency are either a substantial increase in unemployment or higher inflation than rates seen recently.

The unemployment rate is still stubborn 3.6% Despite the dramatic rate tightening, multiple bank failuresand several high-profile layoffs.

The Fed has stuck to a high rate policy to reduce inflation, even Discount rate hiked by 0.25% After the failures of Silicon Valley Bank and Signature Bank. So, unless the US dollar loses its status as the world’s reserve currency (no totally unrealistic worryUnfortunately), runaway inflation is quite unlikely.

the feds said loudly they wanted to reform housing And with inflation and housing prices set to cause a recession, we should expect a continued softening of the real estate market, but without a 2008-style collapse, except perhaps. in commercial real estate,

Of course, nobody has a crystal ball. It is advised to maintain high cash reserves and invest cautiously in troubled waters so that we can keep swimming.

Find an agent in minutes

Get matched with an investor-friendly agent who can help you find, analyze and close your next deal.

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.