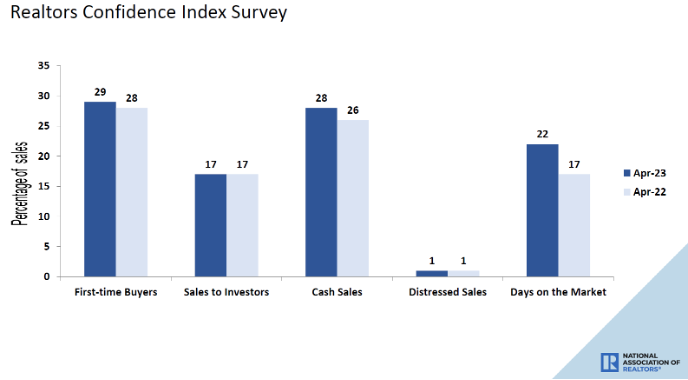

Just when I thought market days were returning to normal, the number of existing homes dropped to 22 days. Why is this so important to me? If days on the market are in the teen years or even lower, that’s not a good sign for the housing market. I would say that being at that level is very unhealthy and even though we are not there yet, we are dangerously close.

To even get close to that level, we either have a massive housing credit boom that will eventually turn into a bust, or we have a housing shortage, meaning too many people with too few. following the houses.

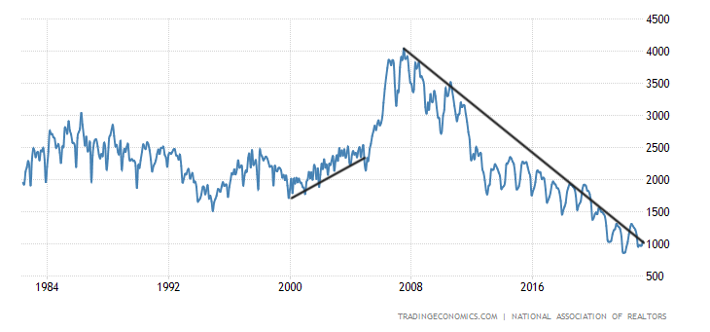

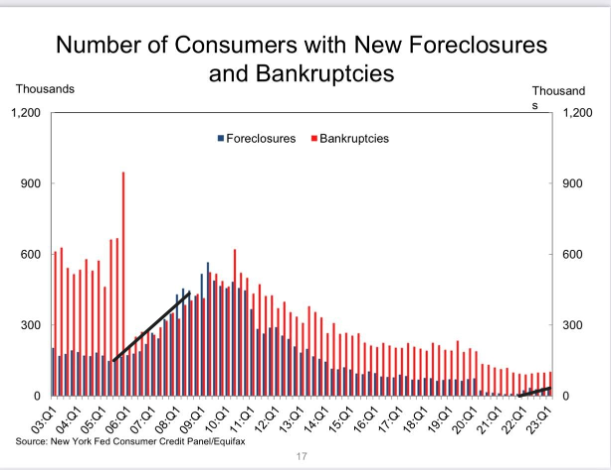

We don’t have a massive credit boom because purchase application data is at historic lows; We haven’t had as much run-up in credit as we saw during 2002-2005. That’s why I always draw the black line on the charts below – to show people that we haven’t had a credit boom for many years. If we had had a massive credit boom-to-bust, inventories would have skyrocketed in 2022.

Instead, active listings are near an all-time low that was not the case from 2012-2019. This is why historically the days to market have been so short since 2020.

Following the most significant home sales decline recorded in US history in 2022 and a stabilization in sales figures in 2023, total active listings are at NAR 1.04 million, from 1.03 million last year, historical benchmarks 2-2.5 million, In 2007, for context, we were up a bit 4 million.

NAR Total Inventory data going back to 1982.

In Thursday’s current home sales report, the data line I used to love dawned on me again. Now I have to consider that despite home sales being at a 10-year low, market days may return to teen levels.

From Male, First-time buyers accounted for 29% of sales in April; Individual investors bought 17% of the homes; All cash sales accounted for 28% of transactions; Distressed sales represented 1% of sales; Properties typically remained on the market for 22 days.

As you can see in the chart above, a down day in the market is not a good thing, but it is the reality of the world we live in post 2010. US housing market inventory channels have changed due to US housing credit channels. got changed. It’s not the same as 2008, nor will it ever be. If it was like 2008, you’re about four to six years ahead in 2023. You would need years of credit stress building up, as we saw in 2005-2008, all before the job loss recession data.

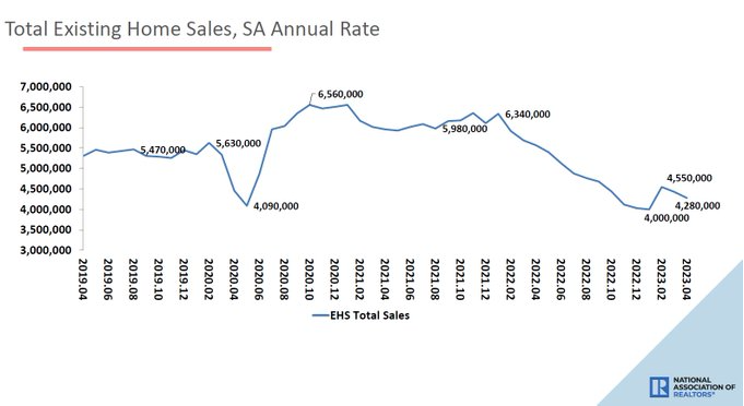

One of my takeaways for current home sales has been that after a big jump in a home sales report, we shouldn’t expect too much to happen. We had a boom in the March report as we recorded the most significant month-over-month sales report ever in US history. However, after that surge, I didn’t think we’d see much growth because that was an unusual occurrence.

NAR: Total existing home sales fell 3.4% from March to a seasonally adjusted annual rate of 4.28 million in April.

When we saw the first boom in home sales 4 million To 4.55 million, This was historically unusual huge print sales month after month. That’s the tricky part of reading high-velocity economic data; When data historically moves slowly from month to month, you have an easier trend to navigate.

However, when you have a collapse like we did in 2022 and then start buying application data from November 9th, 2022, that was a huge setup for a month’s sales print, and then we’ve got to be in a range Should be between 4 million and 4.6 million. While purchase application data had more positive prints than negative prints this year, actual net volumes haven’t increased to break above 4.6 million over the period or below 4 million over the period.

Since purchase applications are very seasonal, and that season is nearly over after May, we should be keeping an eye on mortgage rates now. Up and down mortgage rates have rocked the market. Currently, rates are rising; We saw that effect in this week’s Shopping apps data report, below 4.8% weekly.

However, everything still looks right regarding the 10-year yield and mortgage rates. My 2023 forecast was based on what I believe the 10-year yield will be in the range between 3.21% -4.25%,And so far the range has been correct. That range means mortgage rates will be between 5.75%-7.25%. If jobless claims break above 323,000 at the four-week moving average, the 10-year yield should break below 3.21% and send mortgage rates lower. However, we are no closer to breaking that level on jobless claims.

The recent banking crisis has put further pressure on spreads, and debt ceiling issues have put some market stress on short-dated bonds. We should keep an eye on this because mortgage rates 7% plus Range The housing market has cooled significantly last year and this year. once the rates are gone 5.99% To 7.10%We saw three straight hardcore drops in Purchase App data.

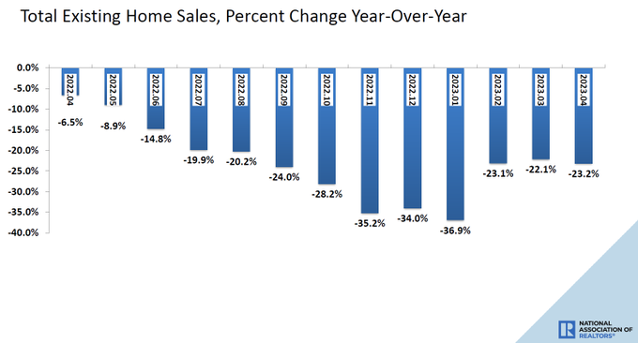

One thing about all the housing data going forward, the year-over-year comp is going to be a lot easier because of the historic decline in demand last year. This will happen in the second half of 2023 and will be especially easy to see in the last two months of the year. So, when we see better year-over-year data in home sales and purchase application data, you have to put an asterisk on that and know that it’s mainly due to stabilizing demand and easier comps .

NAR: Year-on-year, sales fell 23.2% (down from 5.57 million in April 2022).

Overall, there weren’t too many surprises in the current home sales report today, but one harsh reality is that since active listing growth is negative, as we’ve shown in our weekly housing market tracker, days on the market are falling again.

From NAR: “About half of the country is experiencing price gains,” Yoon said. “Even in markets with low prices, multiple-offer conditions have returned in the spring buying season after a quiet winter market. Distressed and forced asset sales are virtually nonexistent.

For the rest of the year, it will be all about mortgage rates and that is where the 10-year yield is going. Remember, higher rates affect sales data just as much as lower mortgage rates; That’s why we track each week for you with the Housing Market Tracker.