New on 12 January Consumer Price Index (CPI) Data was released for December, showing falling inflation rates across the board. Headline CPI, the broadest measure of inflation in the US, declined to 6.5% year-on-year (YoY) from 7.1% a month ago. The “core” CPI, which excludes volatile food and energy prices, fell to 5.7%, down from 6% in November.

While it is encouraging to see a decline in the rate of inflation on a year-on-year basis, the more relevant figures from the CPI report come from the monthly data. The year-to-date data is inherently backward looking, and I think everyone reading this is interested to know what is likely to happen during 2023. The data is a bit mixed.

break down the numbers

This month’s report is very encouraging when we look at the headline CPI, which shows that prices actually fell 0.1% from November to December. For a broad measure of inflation in the US, prices actually went down. This bodes well for CPI in 2023. To keep inflation under control, the pace of price rise only needs to slow down, but it is even better if prices go back like last month.

Core CPI tells a different story, with prices rising 0.3% in December, up from 0.2% in November. This clearly doesn’t bode well, as the pace of inflation has picked up monthly, and the Federal Reserve is focusing heavily on the core CPI. 0.3% monthly inflation is still very high.

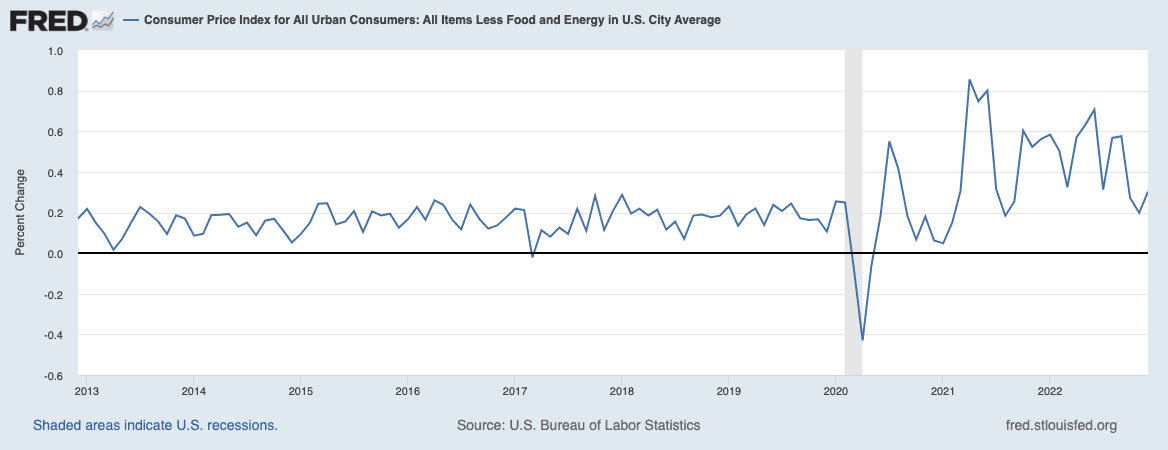

Nevertheless, a look at the last few years clearly indicates that things are moving in the right direction. Throughout 2021 and 2022, core CPI growth was regularly above 0.4%, so seeing it come down to about 0.25% in the last three months is encouraging. But there is still work to be done. Personally, I’m optimistic that things will continue to move in the right direction—mostly because of the one part of the CPI that I’m familiar with—house prices.

One of the key things keeping the core CPI high is “shelter” inflation, which measures the cost of housing (for both renters and homeowners) in the U.S. As measured by the CPI, the cost of shelter last month was about Up 0.7%!

What’s the deal with this? Anyone who looks at the data knows that the cost of housing in America is falling, not rising! rent and House prices They are down marginally right now, yet the CPI is still going up!

This is because the shelter’s CPI measures are delayed by 6-12 months (it’s awful, I know). Therefore, the December 2022 report shows housing and rental figures for the summer of 2022! It’s annoying, but since the housing and rental market started to turn around in June/July, it means that the CPI will start to reflect the reality of housing prices in the coming months. To me, this is a strong indication that the core CPI will fall during the next six months. I can’t see how much and when, but I think it will trend downward in the first half of this year.

what happens next?

i wrote a Article Said in November that I thought inflation had officially peaked and shared my analysis of monthly CPI rates and the reason for my belief. Here’s an update of that analysis.

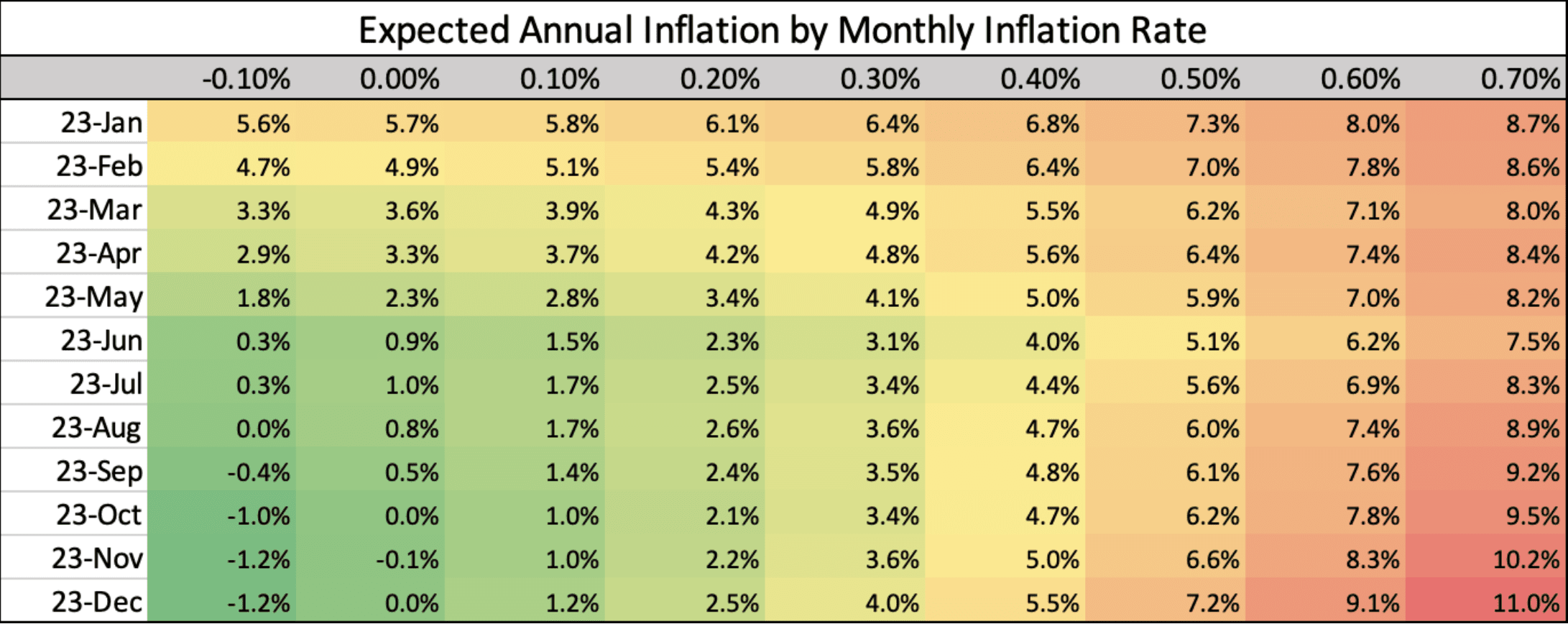

The chart above shows the year-over-year inflation numbers moving forward based on what happens with the monthly increase. For example, if inflation continues to decline by 0.1% each month (as it did this month), we will be below the Fed’s 2% annual target for inflation by May 2023.

I don’t think that’s realistic, and we’ll see modest monthly gains going forward. If we see an average monthly increase of 0.1%, we will be below the Fed’s target rate by June. If monthly inflation rises to 0.16% (which is the average for the past six months), we can expect to remain below the Fed’s target until sometime in the summer. To me, this is a very realistic scenario.

Of course, inflation could pick up again, but that seems very unlikely. In almost every dataset, we see that inflation has peaked and is beginning to return to Earth. Still a ways to go, but it looks like we should get inflation under control sometime this year. This is wonderful news. Low inflation is good for the economy and for every American who has been hurt by high prices over the past few years.

What will the Fed do?

Despite this encouraging news, I expect the Fed to raise the federal funds rate at least once more. But, I think we are approaching the terminal rate (the rate at which the Fed stops raising rates), and we may soon see the end of this tightening cycle.

However, stopping rate hike does not necessarily mean rate cut. The Fed recently issued guidance saying that they do not intend to lower rates in 2023. Many investors think it’s a hoax, but personally, I take the Fed at its word and then hope I’m wrong. Fed is serious About controlling inflation, and although I believe they will stop raising rates soon, they will not lower rates for at least the next six months to ensure that the risk of resurgent inflation is low. Is.

Locked rates are still a good thing though! The economic turmoil we are facing right now is due to uncertainty about Fed policy. If they hold off on raising rates over the next few months, that should give the entire economy a sense of some stability and hopefully lead to a clearer and more optimistic economic outlook.

What do you think will happen in 2023 based on this inflation data? How will this affect your investment decisions? Let me know in the comments below.

On the Market is offered by Fundrise

Fundraise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investment platform.

Learn more about Fundraise

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.