Commercial real estate is facing stress from many directions. The primary stressor is rising interest rates, which are putting upward pressure on cap rates (which push asset values down), making refinancing costs increasingly difficult and expensive. But another risk is looming, especially for the multi-faceted niche of commercial real estate: oversupply. Recent data suggests that there may be a short term glut of multifamily units hitting the market at an inopportune time.

To fully illustrate this issue, let’s take a look at trends in the construction of multifamily properties (defined as properties with five or more units) over the past several decades. As you can see in the graph below, after a significant decline in the number of multifamily units from 2008-2014, both multifamily construction and the total number of multifamily units increased significantly.

Since the start of the pandemic, the upward trend of increased multifamily building has grown even further, and as of Q4 2022, has surpassed one million units under construction for the first time (at least according to data from CoStar).

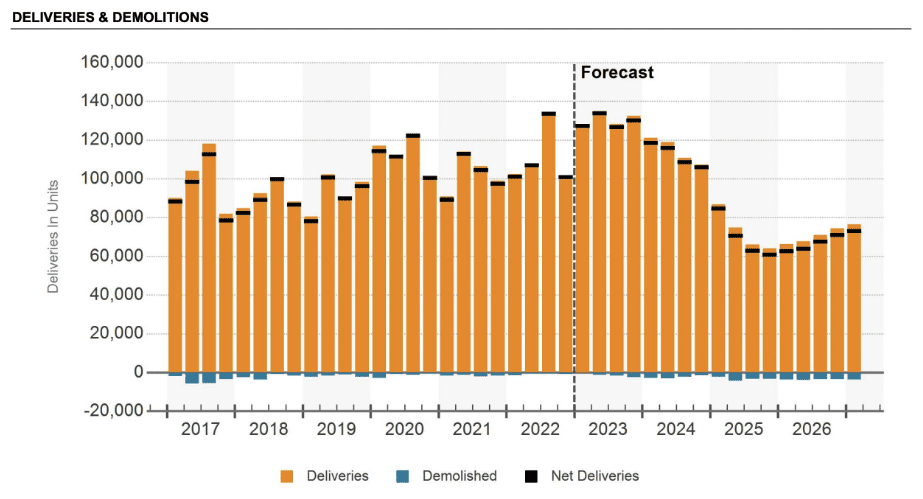

Of course, even in good times, multifamily units take months if not years to build. But the recent years have not been easy for builders – not least in terms of delivery schedules. The construction has taken longer due to supply chain issues and labor shortage. This trend is resulting in a glut of inventory that has not yet hit the market. Looking at the chart below, you can see that CoStar’s forecast for units delivered shows 2023 as the highest on record, with 2024 down slightly but still high. Yes, forecasting is difficult, but forecasting construction deliveries is slightly easier than with other datasets. Due to the fact that builders and developers are required to obtain permits for construction, there are concrete figures regarding the projects that are planned and in the pipeline. Personally, I take this forecast a little more seriously than the others.

If there is proportionate demand to “absorb” the new units then increasing supply is not a problem – but there isn’t. Demand is falling.

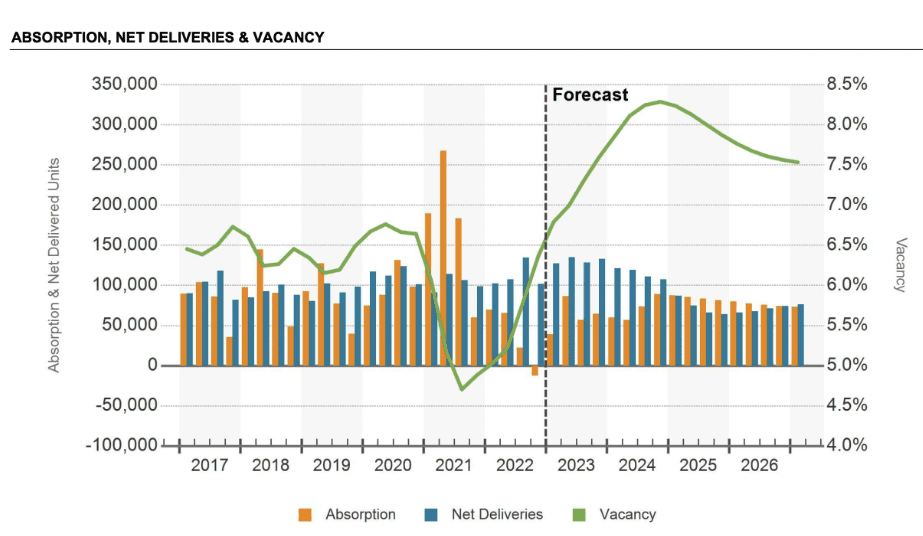

The chart below tells a very compelling story. First, look at the blue bars. This is similar to what we saw above- higher unit deliveries over the next two years. But then look at the orange bars showing “absorption” (a commercial real estate metric that measures demand). It is not continuing.

After a banner year of demand in 2021, “net absorption” (absorption – demand) turned negative, meaning more supply is coming into the market than demand. That was in 2022! In 2023, even more units are expected to come online, and as this graph shows, demand is not expected to keep pace. Of course, some builders may cancel or stall their projects, but this is a costly proposition that builders try to avoid as much as possible.

What happens when supply exceeds demand? The spacing goes up, as you can see predicted in this CoStar projection. This should be a concern for anyone in the multifamily space and for any real estate investor. An increase in supply and a commensurate increase in vacancy can reduce incomes and push rental rates down. The data I’m showing, and my analysis, is about commercial properties, but rent pressure and increasing vacancy in multifamily have the potential to spread to the residential market in some areas.

Of course, this national-level data doesn’t tell the whole story. I took a look at several different markets to see how it fared regionally. What I found is that there is a significant risk of overproduction in some markets. I selected a sample of five markets that I believe are at high risk of increasing vacancy and declining rents for multifamily: Santa Fe, New Mexico; Punta Gorda, Florida; Myrtle Beach, South Carolina; Colorado Springs, Colorado; and Austin, Texas.

| City | EOY 2024 Demand | Gross Delivered Units 2023/2024 | EOY 2024 Inventory Units | sum of absorption units | distribute / list | net absorption | net absorption/inventory |

|---|---|---|---|---|---|---|---|

| Punta Gorda, FL | 2,792 | 1,808 | 3,763 | 1,005 | 48.05% | -803 | -21% |

| Santa Fe, NM | 5,231 | 1,939 | 6,584 | 851 | 29.45% | -1,088 | -17% |

| Myrtle Beach, SC | 17,616 | 4,830 | 21,480 | 2,918 | 22.49% | -1,912 | -9% |

| Colorado Springs, CO | 46,955 | 7,345 | 54,915 | 3,995 | 13.38% | -3,350 | -6% |

| Austin, TX | 259,258 | 34,846 | 299,550 | 18,185 | 11.63% | -16,661 | -6% |

All of these markets have significant construction pipelines, with a high number of units coming to market relative to current supply and expected demand.

On the other hand, many cities, which seemed to me to be small towns, are still doing relatively well.

| City | EOY 2024 Demand | Gross Delivered Units 2023/2024 | EOY 2024 Inventory Units | sum of absorption units | distribute / list | net absorption | net absorption/inventory |

|---|---|---|---|---|---|---|---|

| Missoula, MT | 4,741 | 179 | 5,043 | 373 | 3.55% | 194 | 4% |

| Athens, GA | 10,822 | 55 | 12,018 | 362 | 0.46% | 307 | 3% |

| Midland, TX | 15,722 | 238 | 17,083 | 621 | 1.39% | 383 | 2% |

| Provo, UT | 17,645 | 1,855 | 19,518 | 2,173 | 9.50% | 318 | 2% |

| Topeka, KS | 8,825 | 5 | 9,682 | 126 | 0.05% | 121 | 1% |

Missoula, Montana; Athens, Georgia; Midland, Texas; Provo, Utah; and Topeka, Kansas, all have solid net absorption, and their manufacturing pipelines are very reasonable relative to current inventory levels. To me, there is very little risk of declining vacancy and rents in these cities.

Every market is unique, and I am showing some examples of risky and not risky markets. But I encourage you to do some research on your own and identify how your market is performing in terms of construction. you can get a lot of good data for free on St. Louis Federal Reserve Website Or just by googling the absorption data for your local area.

conclusion

Multifamily properties are seeing a glut of supply in the market at an inopportune time, where rising interest rates are already putting pressure on prices and operators are under cash flow pressure. Thus, 2023 and 2024 could turn out to be tough years for current operators in the multidimensional space.

The important thing to note here is that the excess of supply and the shortfall in demand will likely be short-lived. Long-term construction and demographic trends support strong demand for multi-family rental units well into the future, which bodes well for investors. For example, recent study shows that the US needs 4.3 million more multi-family units over the coming 12 years to meet demand. Home construction is likely to be subdued for now due to short-term economic conditions. Inflation is negatively impacting the spending power of renters, and economic uncertainty is keeping young Americans from owning a home. It is unclear when this economic hardship will end, but when it does, demand is likely to pick up.

In view of this, investors can get good buying opportunities in the coming months and years. With cap rates likely to increase, prices for multifamily should come down. If NOI also falls due to oversupply issues, this will lead to a further drop in prices. This may allow inventors with some dry power to move into multifamily at attractive prices, but remember—this is a risky time. Be careful not to buy for nothing and understand the market dynamics in your local area in detail.

Build Your Wealth With Multifamily Homes

Learn How To Become A Millionaire By Investing In Multifamily Homes! In this two-volume set, The Multifamily MillionaireBrandon Turner and Brian Murray inspire and educate you on how to become a millionaire.

Note by BigPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.