a general question on Big Pockets Forum Something like, “I have $50,000 and I want to invest in real estate. How should I start?”

In normal times, my advice would be home hacking for the first time investor nine times out of 10, especially given the clearly better rates and terms that homeowners can get compared to investors. However, over the past year, the delta in loan terms has narrowed substantially, and so while house hacking is still an option, it’s not as head and shoulders above everything else it once was. However, house hacking has certainly been better than many other strategies.

In fact, if there was ever a challenging real estate market — especially for new investors or those with $50,000 or so burning a hole in their pocket — this would be the one. This 2022 meme explains that challenge as succinctly as any essay can (updated for a 2023 audience):

But sitting on the sidelines also has a cost. on Suzanne Woolley Bloomberg To analyse The dilemma facing investors of all stripes, but especially real estate investors in this current market, is

“In the short term, it makes more sense to focus on preserving capital than finding growth. But in the long run, inflation eats away at cash and reduces the purchasing power of savers.

So, given this predicament, what are the best options for moving forward?

BRRRR Strategy: Mostly No

Don’t get me wrong, if you find a great deal that you can buy at 75% of its market value and it cash flows with current rates, go for it. Unfortunately, for the most part, the BRRRR strategy is dead (or hibernating, to be precise). it’s hard for me to say brrrrr strategy– Specifically, in our case, buying with a private loan, rehabbing, renting and then refinancing with a bank – was our absolute preferred strategy.

The main problem is that virtually every lender is expecting the property to have a debt service coverage ratio (DSCR) of 1.2 or better. That is, your net operating income (gross income minus expenses) needs to be 1.2 times the mortgage payments. Even in high cash flow markets, it is very difficult to get a 75% loan with interest rates in the 6’s and 7’s and prices where they are.

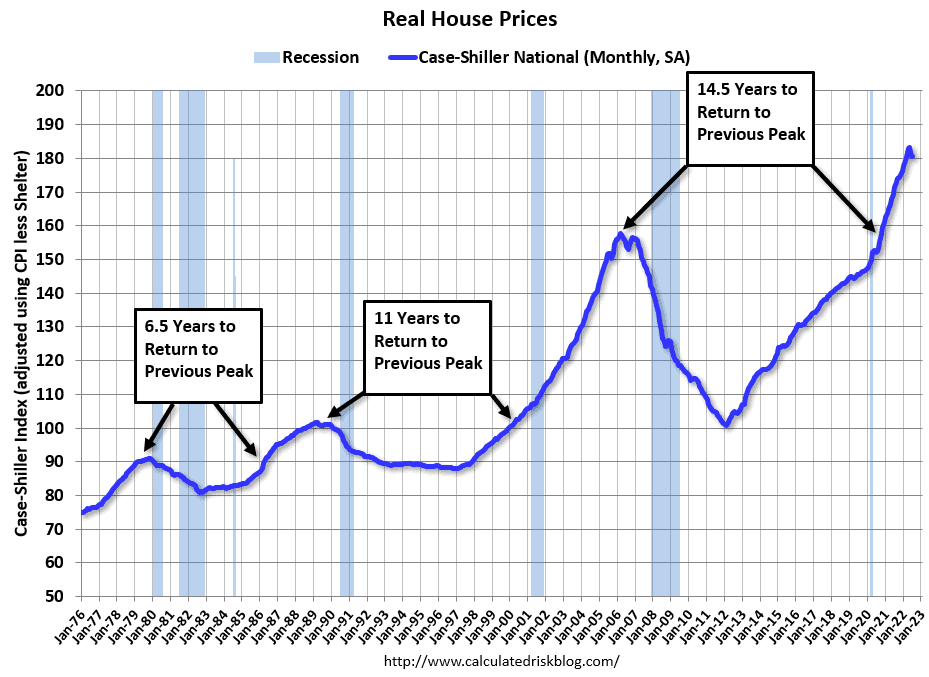

Ahead, Real estate prices have started to fall, Sure, they haven’t fallen much (see the meme above), but after skyrocketing, they’re starting to cool down. A crash is very unlikely, but there is ample appreciation in the near future. as Bill McBride Has shownThe time between a peak for CPI-adjusted real estate prices followed by a decline to the same price again has been between 6.5 and 15 years for the past three cycles.

McBride predicts that, overall, prices will fall 10% in nominal terms and 25% in real terms (adjusted for inflation) from their mid-2022 peak. Of course, opinions on this differ widely. But common agreement It is that real estate prices are likely to fall, are very unlikely to rise by more than a modest amount, and if they do go up, they will almost certainly outpace inflation.

McBride, for his part, believes real estate prices will remain in “refinement” for another seven years. I do.

Therefore, you’ll probably need to drop a lot of money into one property and it’s unlikely to see much appreciation over the next few years. If you have a decent amount of capital or partners willing to go along with the cash, that’s one thing. And of course, if you find a great deal, pull the trigger.

But for the most part, the BRRRR strategy is not ideal in the current market.

sponsored

House Hacking: Possible

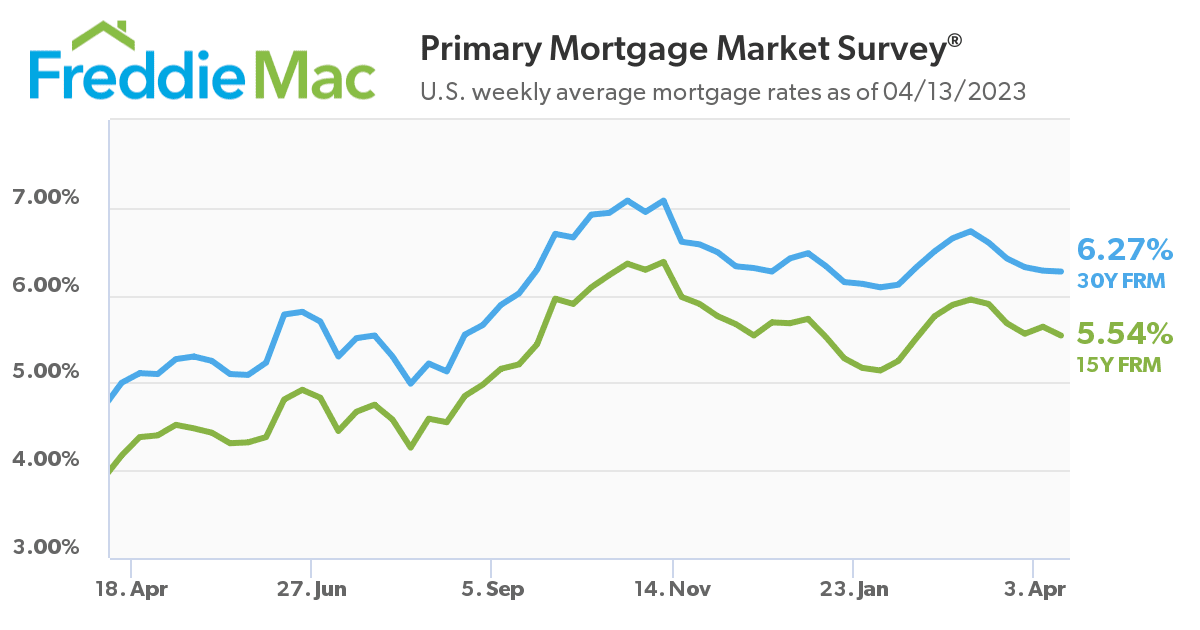

I bought my private residence in mid 2021 and have a 3% fixed mortgage for 30 years. I have heard of many people getting mortgaged in 2s. (I think Mark Zuckerberg holds the record in this regard with 1.05% mortgage, Unfortunately, such rates are a thing of the past.

Today, mortgage rates are in the mid 6’s. Although it is better than the low 7s during the beginning of the year. At least we can all be grateful for the little kindnesses.

While rates are higher than normal, real estate investing is still a good way to get your foot in the door. with and FHA loan, you can do this with only 3.5% down, which would cover $50,000 in almost any market. Plus, you can buy up to a fourplex with an FHA loan, live in one unit and rent out the other three, owning a place to live and being an investor at the same time.

Even many banks will offer traditional financing for homeowners up to 95% of the purchase price.

However, for the first time in my investing career, I clearly cannot endorse house hacking for new investors or those looking to place $50,000 or more. But it’s still definitely an option to consider.

Before proceeding, I must note that inflation has cooled down, so there is reason to believe that interest rates will come down at the end of this year or early next year. So, while I’m generally a big fan of fixed-rate mortgages, it might be time to think about adjustable-rate mortgages. (Although you should insist on testing your financial capability in case rates increase, you never know with such things.)

Creative Financing: Yes

In this regard, I am talking mostly item-by-deal, With such deals, the property is “purchased” subject to the existing mortgage. So, the deed is transferred to you, but the seller remains on the mortgage.

There is a huge opportunity here in this market as most homeowners have great credit, and yet the market has slowed down so it is harder and may take longer to sell (although prices have only dropped slightly because very few people are motivated to sell). and as i put a previous post, “In this case, the benefits to the buyer are obvious. If you can ‘assume’ the loan on the property at 2.85%, how much does the purchase price matter?”

Theme has some disadvantages. For example, the bank has the right to call the loan due, although they rarely do so. Another is that the buyer cannot borrow any money for the rehab. And if there’s a big discrepancy between the sale prices and the loan, there’s no way to bridge that gap without getting a second mortgage.

But for an investor with about $50,000 to spend, that will often do the trick and fill that gap.

It should also be pointed out that seller financing is another option that buyers should consider in this market. This presents the same challenges and the same opportunities, except for the obvious fact that virtually no homeowner is going to lend you a loan at 3% interest to buy your home from them.

Syndication: Mostly No

real estate syndication Usually done on large deals where a major party finds, negotiates and deals with investors to cover the down payment and repairs. Typically, the principal holds about 15-35% of the equity, and passive investors get the rest.

During the past few years, investors in syndication have made handsome money as real estate prices have skyrocketed. But now, returns are lower because interest rates are higher, and (at least so far) prices haven’t dropped enough to offset the reduced cash flow. And as mentioned above, there is no reason to think that real estate prices will rise much in the near future. And they almost certainly won’t keep pace with inflation. Therefore, most of the benefits provided by real estate syndication are no longer there, especially for passive investors.

Of course, even with BRRRR, there are still good deals to be had. And if the market messes up, there may be more motivated sellers and thus more opportunities for really good deals, which will be worth it regardless of the interest rate or potential appreciation. But this has not happened yet.

Personal Loan: Maybe

Private lenders often lend at 8-12% interest. Hard money lenders (businesses set up to lend private money to flippers) typically lend at 12-15%, with three to five digits up.

$50,000 isn’t usually enough to lend to someone buying a home to flip or hold, but if you have closer to $100,000 or more, there should be opportunities out there.

And in fact, with interest rates in the mid-6s, a 10% personal loan doesn’t sound nearly as bad to an investor as it did a year ago. If that type of return meets your goals, then personal lending should be considered.

The Sidelines: Maybe

Another first for me is considering the possibility of recommending people with $50,000 who want to get started in real estate, rather than sit around for a while. Timing the market beats timing the market – or at least it usually is.

This market is one of the few occasions that I would say that sitting on the sidelines for a while isn’t so bad. For our part, we are focused on eliminating our rehab, increasing our occupancy and optimizing our systems. We are not doing much shopping this year. However, that’s partly because we had a big year in 2022 and we’re playing a little bit of catch-up.

As of this writing, The one month US Treasury bond yield is 4%, and returns 5% in six months. This was in the last year. So, sitting on the sidelines isn’t really the equivalent of stuffing money under your mattress as it was not too long ago.

While those returns are still below inflation and negligible compared to what real estate investors aim for, they are much better than buying an average deal with high-interest rate debt in a volatile and potentially declining market.

Ultimately, my recommendation would be not to sit on the sidelines. But I’d actually be more comfortable waiting for a really good deal much longer than last year and far more stable than I was five years ago.

In this economy, especially, you don’t want to force anything.

conclusion

This is the most confusing and challenging real estate market I have seen in my lifetime. I certainly don’t envy someone who just wants to start over. It is important to approach the market with caution and never try to force a trade to happen. There will be time for that, and the economy will, sooner or later, become more profitable for real estate investors.

Still, even in this market, there are opportunities in real estate for anyone with $50,000 or more. You just need to be a little more careful and have a lot more patience.

Creative financing techniques to get more deals done, more often

Is your cash crunch holding you back from your real estate dreams? It doesn’t matter how much money you have in your checking account, there are always fixed assets that you can’t afford. Don’t let the contents of your wallet define your future! This book offers several strategies for leveraging other people’s money for amazing returns on your initial investment.

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.