Down payment assistance makes homes more affordable for home buyers.

Down payment assistance programs remove barriers for first-time home buyers, preventing them from using 10 years of their life savings for the downpayment.

The programs also help American neighborhoods prosper.

When renters become home owners, communities benefit. New homeowners make home improvements, boosting curb appeal and property value. Plus, they spend money at local shops and businesses, which generates taxes for the municipality.

Home ownership is central to the US economy – both nationally and locally, so the government has incentives to promote it.

This is where down payment assistance comes in handy.

This article covers everything you need to know about down payment assistance programs and how to find one for buying your first home.

Click to get your mortgage pre-approved.

What is Down Payment Assistance?

Down Payment Assistance (DPA) is a home-buying program that provides cash grants, low-rate loans and tax incentives to qualified buyers.

Examples of downpayment assistance include:

- $25,000 cash grant for home down payment

- Cash for mortgage discount points and other closing costs

- mortgage loan at concessional interest rates

- forgivable loan for down payment on a home

- State and local tax credits for home buyers

Other downpayment assistance programs give cash grants for specific uses, such as home renovations and making repairs that increase the property’s value.

Downpayment assistance programs are funded by government agencies, private foundations, and local charities. AWARE varies depending on where you live, how much you earn and how quickly you apply.

Click to get pre-approved to buy a home.

How does down payment assistance work?

Down payment assistance programs work by making homeownership more affordable for first-time home buyers.

Down payment assistance programs are administered at the federal, state and local levels. Federal DPA programs include first-time home buyer tax credits, cash grants for home purchases, and interest rate subsidies that maximize home affordability.

Most DPA programs, however, are administered by state and local governments, and private entities and charitable organizations.

Non-federal programs often set specific mortgage types to buyers, such as FHA mortgages; and requires additional paperwork separate from the lender’s mortgage application.

Some DPA programs target professionals such as teachers, nurses and EMTs. Others are available to any home buyer in a specific neighborhood or street.

See all of the first time home buyer programs and grants.

Who Qualifies for Down Payment Help?

There are over 3,000 down payment assistance programs available nationwide. Most DPA programs target first-time home buyers.

Federal DPA programs, such as the proposed $25,000 Downpayment Toward Equity Act, assist low-income first-time buyers and may include additional eligibility criteria. For example, the Good Neighbor Next Door program is limited to teachers, nurses, members of law enforcement and EMTs.

Other programs may require home buyers to live in their new home for at least 5 years.

At the state and local level, down payment assistance programs are often geographic-based and available only to buyers in specific cities, communities or neighborhoods.

Down payment assistance programs are not meant to replace a buyer’s primary mortgage. Instead, DPA programs extend a buyer’s mortgage to make owning a home affordable. Therefore, to qualify for down payment assistance, a home buyer must also qualify for their mortgage.

Get pre-approved and check your eligibility.

5 Types of Down Payment Help

Home buyers can apply for 5 types of down payment assistance programs.

1. Cash Subsidy for your down payment

Cash grants account for most down payment assistance programs. The typical first time home buyer cash grant award is approximately $10,000.

Cash grant down payment assistance does not require home buyers to pay it back. However, grant programs are meant to build community and promote economic development, so they usually have a 5-year clause that states the buyer must live in the home for five years or at least partially repay the grant. should be paid from

The proposed Downpayment for Equity Act is a cash grant program with a payback period of 5 years. It gives first-time buyers up to $25,000 in cash for downpayments, closing costs, and other home purchases.

Get pre-approved to check your eligibility.

2. Closing Cost Credit

The Closing Cost Credit is a cash grant, paid at closing, that reduces the cash needed to purchase a home. They can be applied to mortgage closing costs, real estate taxes, title fees and any other costs associated with buying a home.

When you receive closing cost credits as a home buyer, you are not required to repay them. However, some programs require buyers to maintain residency for at least 36 months.

The most common type of closing cost credit are seller rebates.

Seller concessions occur when the home seller contributes a portion of their home sale proceeds toward the buyer’s closing costs. Seller concessions can range from a few hundred dollars to as high as 6 percent of the purchase price.

Author’s Note: The no closing cost mortgage is not a mortgage type. This is not a down payment assistance program.

3. Interest rate cut

Some cities make homeownership more affordable by subsidizing lower interest rates for home buyers through cash grants for mortgage discount points.

A mortgage discount point is a one-time, up-front fee paid at closing in exchange for a lower interest rate. One discount point costs one percent of your loan size and can lower your rate by 0.25 percentage points.

Get pre-approved to see the interest rate deductions available to you.

4. Property Tax Bill Credit

The property tax bill credit and tax deduction differ on down payment assistance. They are available to all home buyers – not just first time buyers.

Tax bill programs provide tax exemptions and tax relief to home buyers in specially designated areas of the city. Buyers receive favorable, long-term tax treatment, lower their tax bill and save money.

Some states and counties issue mortgage credit certificates of up to $2,000, which offset local property tax bills dollar for dollar.

5. Down Payment Loan

The least common form of down payment assistance is the interest free down payment loan.

Interest free down payment loans are secured by a lien on your home and require no monthly payments. The down payment loan is repaid from the sale proceeds of your home when you sell your home or choose to refinance it.

How to get down payment help to buy your home

There is no comprehensive national database for down payment assistance programs. Some home buyer programs apply automatically, including property tax exemptions and federal tax credits for first-time buyers. Other down payment assistance programs can be claimed with only one application.

Local and state DPA programs are often not advertised, and are poorly publicized.

The US Department of Housing and Urban Development (HUD) maintains a semi-complete list of programs listed by state, county, and city.

Before applying for down payment assistance, review the terms and conditions to make sure they fit your financial goals. For example, some DPA programs require buyers to finance with an FHA mortgage. Others may impose a residency requirement of five years or more.

Down payment assistance applications can slow down your home purchase, adding weeks or months to your home purchase timeline.

How much money do you need for down payment?

Home buyers don’t need any money for a down payment because of down payment assistance programs and low- and no-downpayment loans.

Profile of home buyers and sellers according to the National Association of Realtors® 2021:

- 87% of home buyers use a conventional mortgage, which allows for as little as 3%

- 7% of home buyers use an FHA mortgage, which allows 3.5% down

- 5% of home buyers use VA mortgages, which allow no money down

- 1% of home buyers use other loans, including 100% USDA mortgages

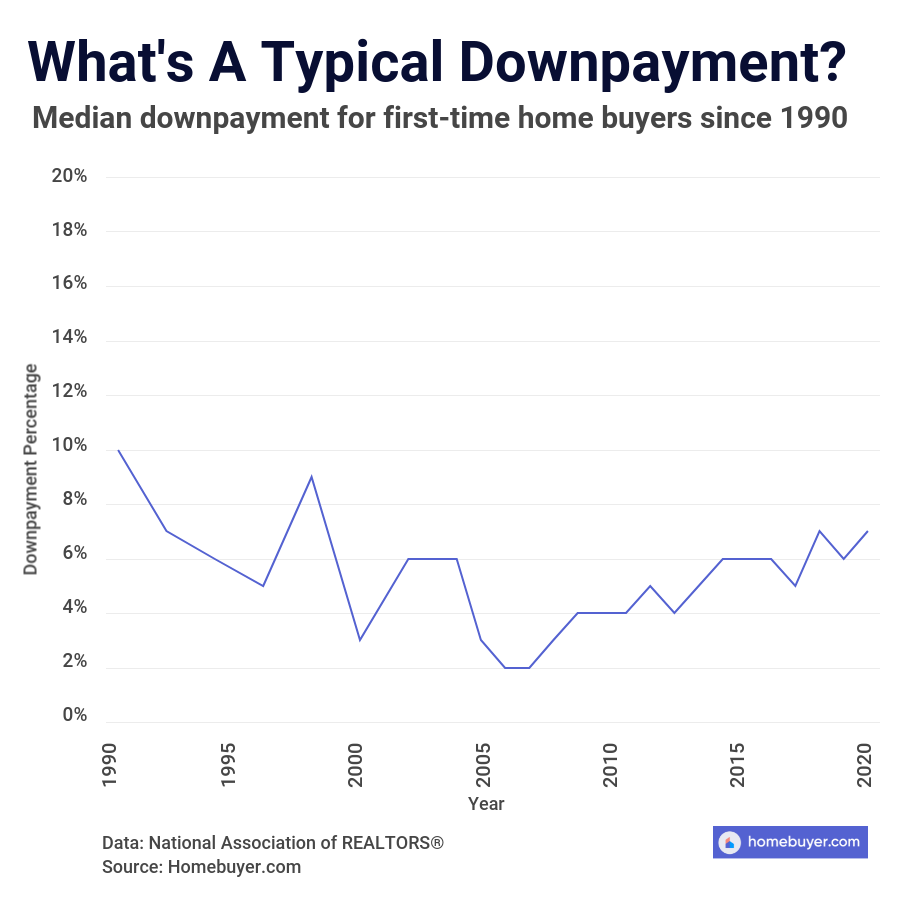

The average first time home buyer down payment is 6 percent.

Get pre-approved for a low down payment mortgage.

Our advice to home buyers: Use down payment assistance when it is available without rules

Down payment assistance programs are available to most US home buyers and buyers should consider them when they are available. Down payment assistance makes homes more affordable and helps renters live their American dream.

Some programs, such as federal programs that provide tax credits and incentives to qualified first-time buyers, are automatic and non-conditional. They do not impose any other restrictions.

State and local programs, however, may place constraints on financing or home type, and require buyers to use a specific mortgage type or mortgage companies, which completely offset the benefits of the down payment assistance program. .

If you plan to use local down payment assistance program status, compare buying a home with and without a DPA side-by-side to make sure you’re getting a good deal.

mortgage

prior approval

in minutes