This article is based largely on A video by Frank and Brian of National Real Estate Group, I’m pulling directly from this video because I think they do a good job of summarizing the iBuyer landscape.

What is an iBuyer?

First things first, iBuyer is a real estate entity with technology behind it. Right now, the big iBuyers are Zillow, Offerpad, and Opendoor. They are using the scale to buy homes and then sell them at a markup. Like other disruptors (Airbnb, Lyft, ClassPass), the notion is that iBuyers may soon blow away real estate norms and make the experience cheaper and better for end users: buyers and sellers. That was my assumption/worry (as an agent), at least.

So, let’s look at the three basics:

- When would it make sense to use iBuyer?

- Is it cheaper to use iBuyer than using an agent?

- What is the future for iBuyers?

What You Need to Know About iBuyers

-

When would it make sense to use iBuyer?

At this point, iBuyers is supporting and targeting sellers more than targeting buyers. Most iBuyers are interested in single family homes that are relatively new. This would mean they were made between now and 1960-ish, which might not sound that new. But in areas close to downtown Denver (and other city centers), it eliminates a lot of properties because they are condos or older homes.

We still don’t think this is a good deal for sellers (more on that below), but there is one occasion where it could make sense. If you are more concerned about convenience than money then using iBuyer may make sense.

If you sell your home but haven’t chosen somewhere to move yet we can look at this. Rather than move out, get an apartment temporarily, and move again when time permits, many of these iBuyers will allow you to stay in their place for an additional two months while you find your new location. .

Similarly, if a quick lifestyle change is required (eg, job out of state, ill health), iBuyer may make sense due to the speed of the process.

Connected: News Flash: Zillow Is Not a Game-Changer in Real Estate

-

Is it cheaper to use iBuyer than using an agent?

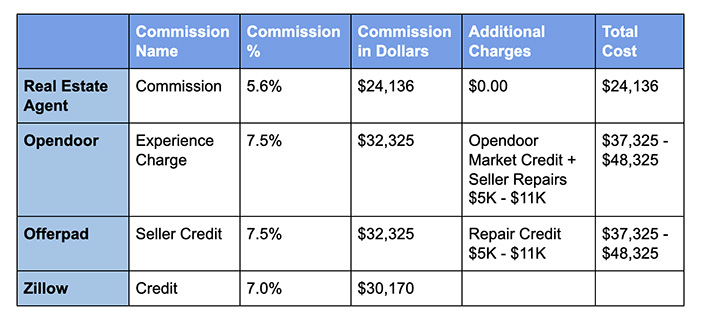

Absolutely not. Clearly, iBuyers cost sellers more to use and sell for less than a traditional agent. The norm now is that sellers pay both commissions (buyer’s agent’s commission and seller’s agent’s commission). The cost of those commissions is typically between 5.6 and 6 percent (gross) of the cost of the home.

Therefore, for a $431,000 home, the seller’s commission value would be $24,136. plan. I know. It hurts, but bear with me.

iBuyers doesn’t call them “commissions,” but as of July 2019, they’re charging a rate of between 7 and 7.5 percent and call it an experience fee or seller credit. The use of the word “credit” is confusing because it sounds like money back in your pocket. But in reality the money has run out.

Therefore, for a $431K home using an iBuyer, you would be paying between $30K and $32K in commissions. (More hurt.) On top of that, they have been known to add between $5K to $10K of extra cost.

Therefore, when you compare the cost of a traditional agent with iBuyer, you pay more with iBuyer. For a sale of $431K, you would have to spend about $24K in commission. For an iBuyer you will pay $30K in upfront costs plus an additional $5K to $10K in (potential) costs, bringing your total cost to iBuyer to $40K. Clearly, using iBuyer is more expensive.

Another reason not to use iBuyer. iBuyers make their money on the spread for which they buy your home and later turn and sell it. So, they want you to sell your place for as cheap as possible. In contrast, a traditional agent’s commission is directly tied to how much you sell your place for, so they’re motivated to get you top dollar (because then they get top dollar).

Connected: 5 factors to check before buying that property you found on Zillow

-

What is the future for iBuyers?

As an agent, I’ll admit I’m intimidated by iBuyers. It looks like they may clear out the field of agents in the next five to 10 years. They are currently taking steps to do so, But I don’t think they are there yet.

The value proposition they offer isn’t strong enough or big enough (yet) to make this happen, but it’s reasonable to assume it’s coming. For now, I’ll probably just invest in the stock while it’s still cheap, and keep an eye on what’s to come.

Source:

https://www.thedenverchannel.com/lifestyle/real-estate/may-2019-ended-with-more-homes-for-sale-in-metro-denver-than-any-other-month-in-the- last five years

What is attractive or unattractive to you about iBuyers? Do you think real estate agents should be afraid of iBuyers? why or why not?

Weigh in with a comment below!

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.