The combination of economic instability with (relatively) high interest rates and the fact that most homeowners have fixed, low interest rate loans prompted real estate economist bill mcbride refers to as “Vendor Strike”. As is to be expected after such stubbornness, developers are launching a “builders’ strike” to follow suit.

As cnbc informed of at the end of October, According to the U.S. Census, “Housing starts for single-family homes fell nearly 19% year-over-year in September. Building permits, which are an indicator of future construction, fell 17%. PulteGroup, the country’s One of the largest homebuilders, reported that its cancellation rate increased from 15% in the second quarter of this year to 24% in the third quarter.

By Rick Palacios Jr., director of research at John Burns Real Estate Consulting an interesting thread On builder sentiments from across the county. This is not good at all.

The home builder comments from our survey this month were as negative as I’ve seen to date. See here some colors of the market that jumped…

— Rick Palacios Jr. (@RickPalaciosJr) November 9, 2022

Some samples include a builder in Boston saying, “October was exceptionally weak,” in Baltimore, “the market is terrible,” and in Wilmington, “the market is falling off a cliff,” etc.

you get the idea.

Overall, single-family housing is declining rapidly. However, the introduction of multifamily housing, somewhat surprisingly, remains relatively stable, It is likely that some degree of government-subsidized multi-family building construction is done. LIHTC ProjectsBut even then, they are likely to subside soon.

Of course, a major slowdown in construction is to be expected. New construction has always been heavily dependent on interest rates, and the Federal Reserve brought in a discount rate that drove down the mortgage market. 0.25% to 4.5% in less than a year.

the reason The collapse of the real estate market is unlikely That’s because, unlike in 2008, homeowners have access to low-interest fixed-rate loans, lending standards are relatively strong, and most have a good amount of equity in their homes. None of this has anything to do with the calculus developers use when deciding whether to build a property. In other words, the fundamentals holding back the housing market do not apply to the market for new construction. Thus, new construction is rapidly declining and may possibly collapse.

In other words, the builders are frustrated and they are going on strike.

However, they can’t do this before overrunning and destroying what has become a minor boon to the US economy: a new manufacturing glut.

upcoming new construction glut

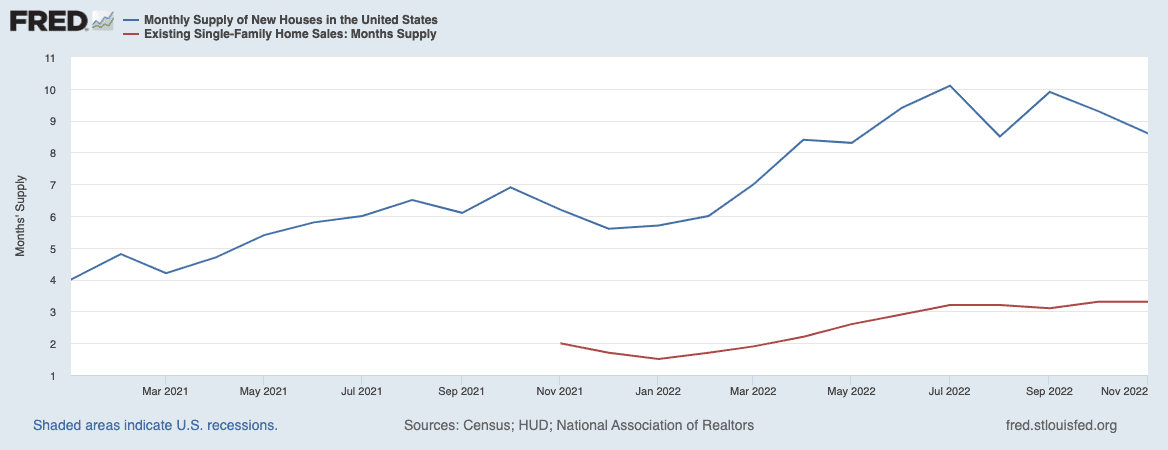

already, record 29% The number of homes for sale in the United States are new construction. buyer cancellation increased by 7.5% From September to October new construction showed no signs of abating. Months of inventory for new construction from January 2022 to October has increased by more than 50% from 5.7 months to 8.9 months. (Generally, six months’ inventory is considered a balanced market).

And while the time it takes for new homes to sell has typically outpaced existing inventory, the difference between the two has become stark. In October, there was only 3.3 months of inventory for existing inventory (still a seller’s market), only one-third of that for new construction.

Unfortunately, there’s no real reason to believe it’s going to get better before it gets worse. while inflation it’s a bit coldThe Fed has indicated that they plan to keep rates high (relatively speaking) At least until 2023.

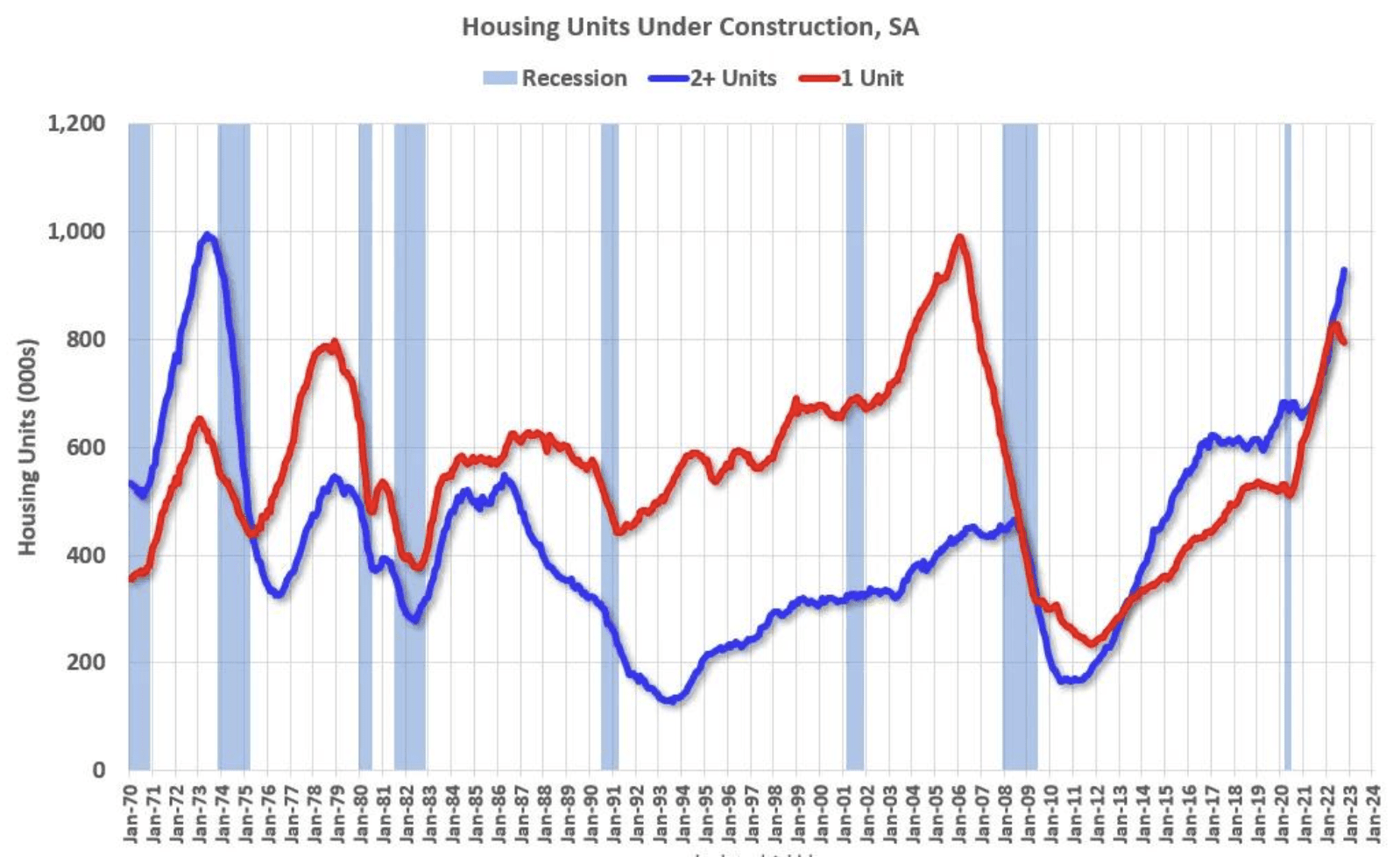

But possibly more importantly, as Bill McBride points out, there are more housing units under construction than ever before!

“Red is single-family units. Currently, there are 794 thousand single-family units (red) under construction… blue is for 2+ units. Currently, there are 928 thousand multifamily units under construction. This is the highest number since December 1973.” Level!”

“Combined, there are 1.722 million units under construction. This is an all-time record number of units under construction.

The growth in manufacturing was in large part nationwide housing shortagewhich is mainly boosted skyrocketing housing prices over the past few years. In addition, supply chain issues have delayed several estimates, leading to a backlog of properties intended to remain under construction for a long time.

Unfortunately, unlike homeowners who are rarely forced to sell, builders have little choice. Sure, many people will turn to renting these new constructions, but the rental market is already begin to satiate, For most, they will have no choice but to sell in a buyer’s market and what is likely to be more than one.

conclusion

With notable exceptions (most notably those that are subsidized by the government, such as LIHTC), this is probably not the best time to start new development projects. If you are a developer in the middle of such a new construction, it would be worth at least considering whether it is economically viable to rent out the property (or some of the properties when developing a subdivision).

If selling is the only option, it would be wise to get ahead of the curve. While existing home prices will only drop a moderate amount over the next year, new home prices will drop significantly. You don’t want to get stuck chasing the market down while you hold onto inventory. I would recommend leading the market and cutting your price. offering attractive incentives such as Rate of interest Buy-down (where the builder pays the lender to reduce the interest rate for the buyer in the first year or so), should also be considered.

Every investor and developer will take a hit in this business at some point or the other. Better to come up with one instead of trying to hope that you can sell now for the same price the typical homeowner was buying with interest rates in the 3% range. To hope that the market will go back to where it was six months ago will likely leave you holding the bag as the cost of holding eats up any profit you might have made. And after that, you’ll probably have to sell for less than the discount you could have offered before.

On the other hand, if you’re looking to buy a house—especially one to live in—and are discouraged by this meme, that’s a lot closer to reality than such a buyer:

Will have to look at new homes. Pay particular attention to someone’s offering rate buy down. Either way, you’ll have the upper hand in the conversation.

On the Market is offered by Fundrise

Fundraise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investment platform.

Learn more about Fundraise

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.