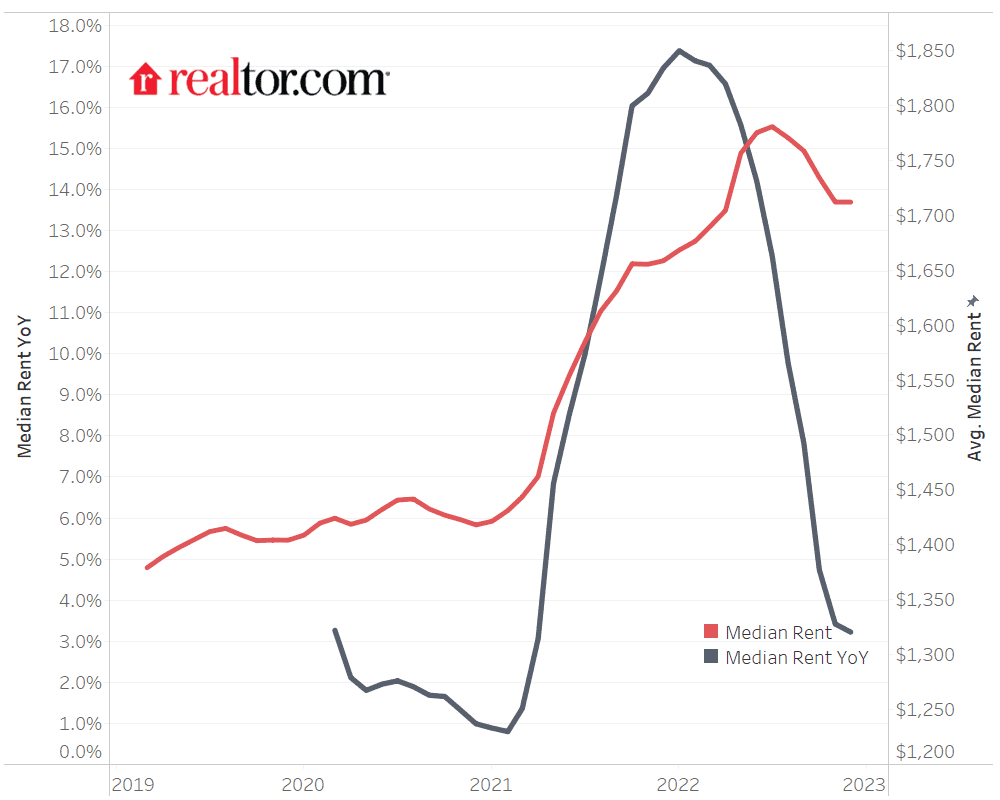

I’ve rarely seen anything like the nationwide rents have taken off over the past year.

Take a look for yourself.

Of course, this is only showing the year-over-year change and not the fares themselves. Rents have been rising year-on-year despite peaking dramatically around last March. That being said, we have reached a point where rents have started declining even marginally month-on-month.

As realtor.com notes,

“In November 2022, the US rental market experienced the fourth consecutive month of single-digit growth after ten months of slow growth from January’s peak of 17.4% growth. Average rental growth across the top 50 metros slowed to 3.4% year-on-year for 0-2 bedroom properties, the lowest growth rate in 19 months. The median asking rent was $1,712, down $22 from last month and $69 from the peak But still $308 (21.9%) higher than this time in 2019 (pre-pandemic).” [Emphasis mine]

And if we account for inflation, the decline is even sharper.

Other than this, “builders strike”This, as I put it, “could also derail home buying plans and further push up rental demand.” The supply side also signals poorly (or signals well depending on your point of view) for future rental prices,

“On the supply side, the number of properties for rent may gradually increase as housing activity continues to pivot to multi-family properties. This additional supply of multi-family homes may alter the market balance, still less Could push up rental vacancy rates and help offset recent rent increases driven by excess demand.

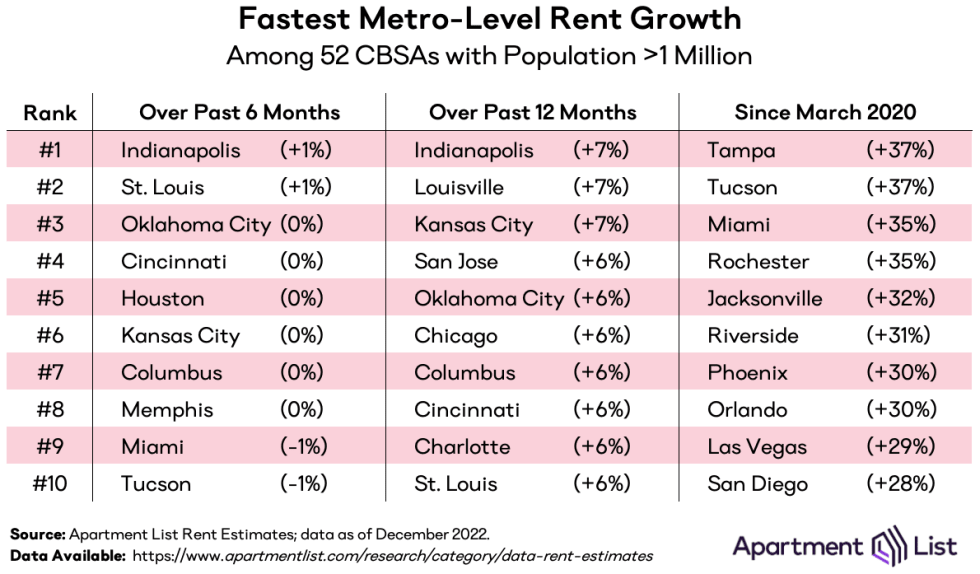

To see how dramatic this shift has been for homeownership, compare the fastest metro-level rent growth in the top ten cities over the last six months, 12 months and since the start of the pandemic, according to the data apartment list, This is an increase of 37% since March of 2020 (Tampa) to 7% over the past 12 months (Indianapolis) to 1% over the past six months (Indianapolis).

Here’s everything you need to know about when the fastest-growing metro area is at 1% growth.

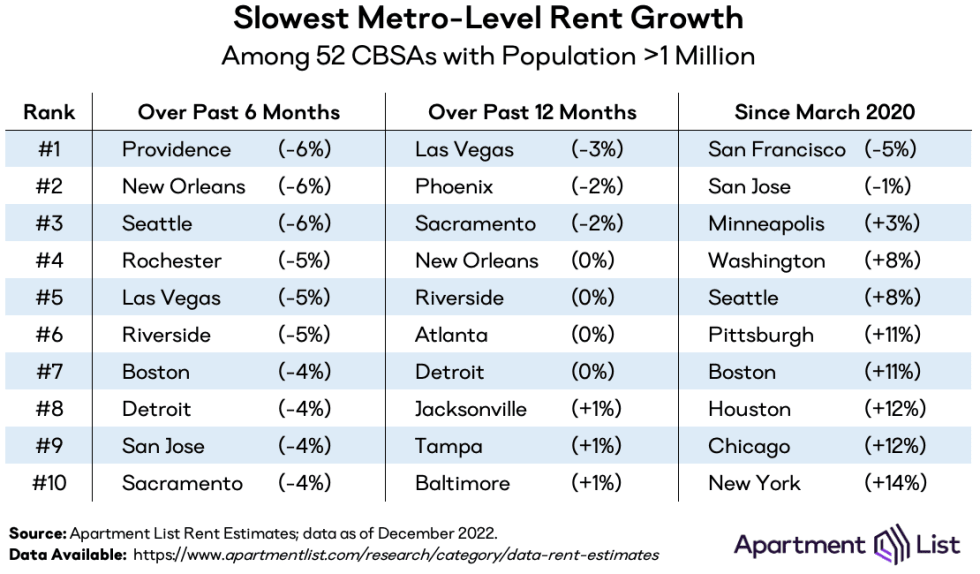

For what it’s worth, the worst-performing market over the past six months was Providence, Rhode Island, at -6%. San Francisco has been the worst since March 2020, at -5%, but that’s mostly due to local factors, In fact, San Francisco is one of only two markets with negative rent growth since March 2020 and one of only five markets with positive rent growth of less than 10%.

With all this, from November to December, the rent prices actually stabilized. Maiden’s rental growth is still a little over 3% for the top 50 metros. That’s slower growth than the past few years, but growth nonetheless, and shows that a much more “normal” market is back.

Why did the rents fall then?

Part of it is just seasonal. Both prices and rents tend to go down a bit in winter. But the overall dip is huge would predict than normal seasonal, There is much more to the story than this.

Before the Fed started raising interest rates, real estate prices were skyrocketing due to various factorsmost notably historically low interest rates and large, nationwide housing shortage It came from a decade of inadequate housing construction. This shortfall in supply was then further compounded by the delay caused by Covid and the lockdown.

The housing shortage has had the same effect on the rental market as it has on the sales market. However, when rates rose, a “sellers’ strike” ensued and new listings fell dramatically. Remember, unlike in 2008, most homeowners today have 30-year term loans at low interest rates. There is little incentive to sell.

so one of the first pieces of advice I It was a new and very strange market,”[I]If you are the owner of your house and you have to move due to work or other reasons, then selling your house is not the way to go.” You really should never sell or refinance a home with an interest rate of 3% or less.

“Instead, it makes more sense to rent your current home and then move to where you’re going (assuming it doesn’t make sense or is impossible to buy there). “

It turns out that many people took this advice or had similar thoughts. At the same time that new listings are down, we’ve seen the number of rental listings shoot up for both our homes and apartments in each submarket of the Kansas City metro area. This is visible in the whole country.

In addition, while renting on new listing were increasing by over 15% from one year to the next, which was not even close to the increase in rent paid by the average tenant. As npr told“Government consumer price data shows that what the average American actually paid — not just the change in price for new listings — rose 4.8% over the past year.”

The average increase on lease renewals hasn’t come close to the average increase on new rental listings. Thus, it is not surprising that many tenants (like home owners) are not moving.

Americans, overall, are runs lower than at any time since 1948And according to data from RealPage, Apartment lease renewals are at 65%Up about 10% from 2019 only.

More properties coming into the rental market increases competition and puts pressure on prices. At the same time, most tenants weren’t paying rent at market rates for new listings six months ago because their lease renewals weren’t keeping up with market growth. Thus, they do not have much incentive to move if it costs them a lot to do so.

Several other trends have also contributed to this situation. One is that many construction projects that were delayed due to Covid have finally come online, adding additional supply to the market. In addition, inflation and rising housing costs were approaching. power limit In the middle of 2022. This has constrained rent growth, notably by persuading more Americans to move in at once.

maximum one to three adults rely on their parents for financial support, and many young adults, in particular, taken to move back in with his parents, More Americans are also willing to rent out a room or part of their home. A Realtor.com survey found that a full 51% of homeowners were willing to rent out additional space in their homes, the highest rate among Millennials (67%). In fact, Americans living with roommates are an increasingly prevalent trend over the years,

All these trends together are bringing rental prices back down to earth.

Is It A Bad Idea To Rent Out Your Property Now?

as well as real estate market in general, it is highly unlikely that the rental market will collapse. After all, there’s still a housing shortage, and new construction is slowing again due to high rates (at least by recent standards). Moreover, if the trend continues, the rental prices are at the level for now.

Also, many people who were looking to buy a house are in the process of giving up and taking it on rent. As their plans change, this will increase demand and put pressure on the market. And again, part of this recent decline is just seasonal, and as we enter the warmer months, the market should warm up again (perhaps intended, I’m not quite sure), at least somewhat. .

The skyrocketing rents of the last few years were an aberration, and the fact that they are coming back down to earth may not be great for landlords, but it is better for the country as a whole. While higher interest rates make new purchases more difficult, the rental market should stabilize.

You shouldn’t expect that next year’s rents will be much higher than they are now. But I wouldn’t worry too much about your being unable to rent out your properties.

New! Updated Rental Market Data – Top 100 US Markets

Download Dave Meyer’s latest dataset that shows average rents and annual and monthly growth rates for the largest 100 markets in the US.

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.