It was a wild ride for the housing market last week! The 10-year yield increased significantly, sending mortgage rates nearing 7%, right in the middle of the spring sales season. New listing figures fell, however, active inventory rose. And Purchase Apps had a weekly negative print, continuing the 2023 theme of higher rates hitting data.

Thank you for reading this post, don't forget to subscribe!Here’s a quick recap of the past week:

- Total active listings increased 3,809 weekly, but new listings are still trending at an all-time low.

- Mortgage rates increased last week as we started the week at 6.55% but ended at 6.90%.

- Purchase application data fell 4.8% weekly as the streak of higher rates affecting weekly data continues.

weekly housing list

They say that slow and steady wins the race; Well, for housing inventory in 2023, it’s been very slow this spring. How slow has active listing growth been? Here’s my crazy stat for the week: At this time last year, the weekly active list was up 25,542 In just one week. This year the total has only increased from the seasonal level. 18,722.

Can anyone call wild unhealthy? In my wildest dreams, I never would have thought this could happen with it being so close to June.

- Weekly Inventory Change (May 5-12): Inventory increased 420,381 To 424,190

- Same week last year (May 6-13): Inventories increased from 312,857 To 338,399

- inventory bottom for 2022 240,194

- 2023 is the peak so far 472,680

- For reference, in the active listings for this week 2015 Were 1,108,932

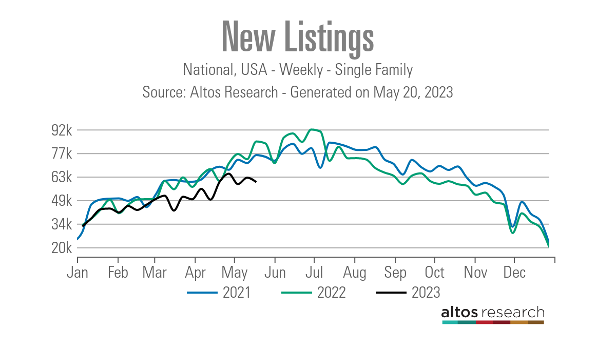

New listing data fell last week, according to Altos Research, and the year-over-year decline is very noticeable as we’re trending toward an all-year low. However, at this time last year, we saw some new listing growth relative to 2021 levels. In the second half of 2022, mortgage rates increased to 7.37%, and new listings began to turn negative as some people gave up on listing their homes with such high rates.

Here’s the new listing data for this week over the past several years:

- 2023: 59,651

- 2022: 84,298

- 2021: 76,051

And to give some historical perspective, here’s new listing data for the same week in more common years:

- 2017: 89,411

- 2016: 90,048

- 2015: 90,323

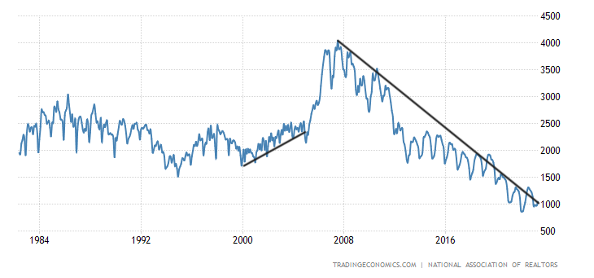

NAR data goes back decades and shows how difficult it is to get total active listings back into historical range 2 million To 2.5 million, The latest current home sales report, which I wrote about here, showed where the year-over-year growth came from. 1.03 million To 1.04 million,

NAR: Net Inventory:

10 year yield and the mortgage ratso

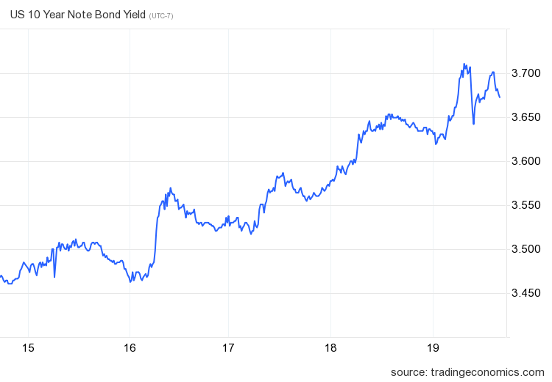

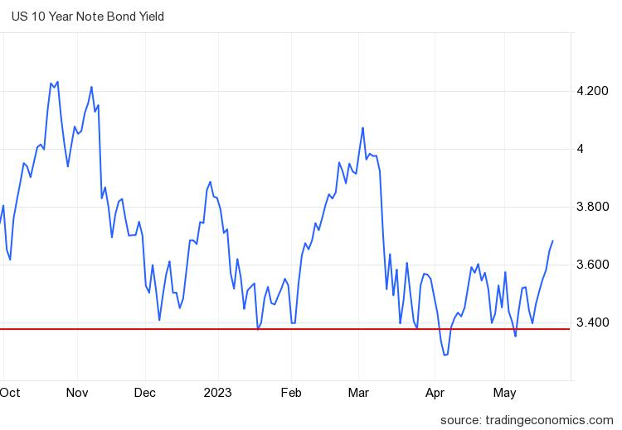

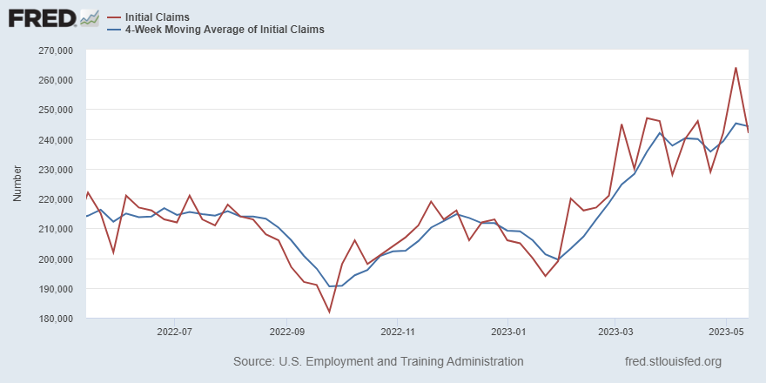

A crazy week in the 10-year yield pushed mortgage rates higher. We’ve had a lot of play points with the debt ceiling issue, but there was a good report on jobless claims data, reversing the big negative number in the past week.

When I talk about mortgage rates, it’s really about where I think the 10-year yield will go for the year. In my 2023 forecast, I said that if the economy remains stable, the 10-year yield should be in the range between 3.21% and 4.25%Equal to 5.75% To 7.25% mortgage rates.

Now if the economy weakens, meaning the labor market sees a significant increase in jobless claims, the 10-year yield should break 3.21%going all the way 2.72%. it will drive down mortgage rates 6%And if spreads normalize, it could even bring us down 5% Mortgage rates again.

However, on that front, jobless claims had a good week as they fell which is a positive sign for the labor market, not a negative one.

From the St. Louis Fed: “Initial claims for unemployment insurance benefits declined by 22,000 to 242,000 in the week ended May 13, reducing the four-week moving average to 244,250.”

buy app data

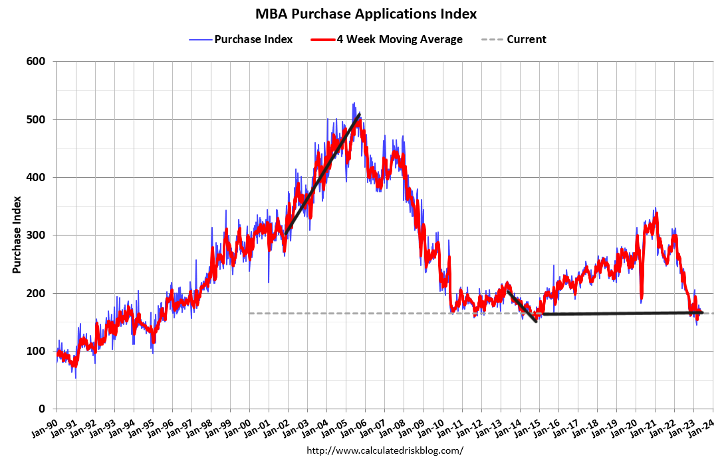

The housing market changed significantly when mortgage rates peaked at the end of the year and began to decline. During that time, purchase applications had more positive than negative prints, which stabilized demand. As we can see below, our deluge into shopping apps halted as rates dropped.

However, even with this, whenever rates go up, it negatively affects the weekly data, and last week shopping apps were down. 4.8%, With mortgage rates rising back closer to 7%, this week’s application data is likely to be negative.

when mortgage rates go up 5.99% -7.10% Earlier this year, we had three weeks of negative data. Then as rates fell, the data line improved — traditionally, total volume peaks in May, and seasonality kicks in for the rest of the year. I am eyeing the second half of 2023. If mortgage rates fall significantly, there could be another surge in demand towards the end of the year, similar to what we’ve seen over the past three years.

week ahead

We’re getting closer and closer to some short-term solution to the debt ceiling issue, but this week’s wild ride may still be crazy. The debt ceiling issue is a wild card for market activity this week, with or without a resolution, so the focus will be on patting it out or until September. The market will pay more attention to that than the economic data this week.

However, we do have some key economic reports this week, including new home sales, pending home sales, and personal consumption inflation data on Friday, which the Fed wants to get closer to 2%. The world likes to pay more attention to CPI inflation data, but core PCE at 2% is the Fed’s target level.

The marketplace knows that inflation growth peaked last year, but it is trying to time the economic expansion and the next job-loss recession to begin. That’s why I emphasize the weekly jobless claims. We need to keep an eye on the 10-year yield because, due to the debt default fiasco, bond yields could have a chaotic week, moving up or down quickly.

Which is why in these weeks, when we have political factors, we must be careful about making statements about long-term changes in the data. Once this drama story ends, we can focus on the real economic data.