For potential homebuyers, the onslaught of jargon paired with figuring out how to finance a new home can be overwhelming. Millennials, in particular, may experience more distress as many assets may be out of their reach.

To provide some helpful insights, Porch surveyed over 1,000 Millennials about their experiences before, during, and after buying their first home.

road to home ownership

Many millennials may feel the pressure to buy a home later. Home ownership is often advertised not only as a major life milestone but also as a testament to one’s maturity.

Being financially secure throughout the process should be more important than trying to race against an imaginary deadline.

Connected: Survey says: This is what first time home buyers want today

Millennials who had not yet purchased a home believed they would not be ready to do so for another two and a half years. Their hesitation seems justified, with 44 percent saying they weren’t on track to meet their home-buying goals.

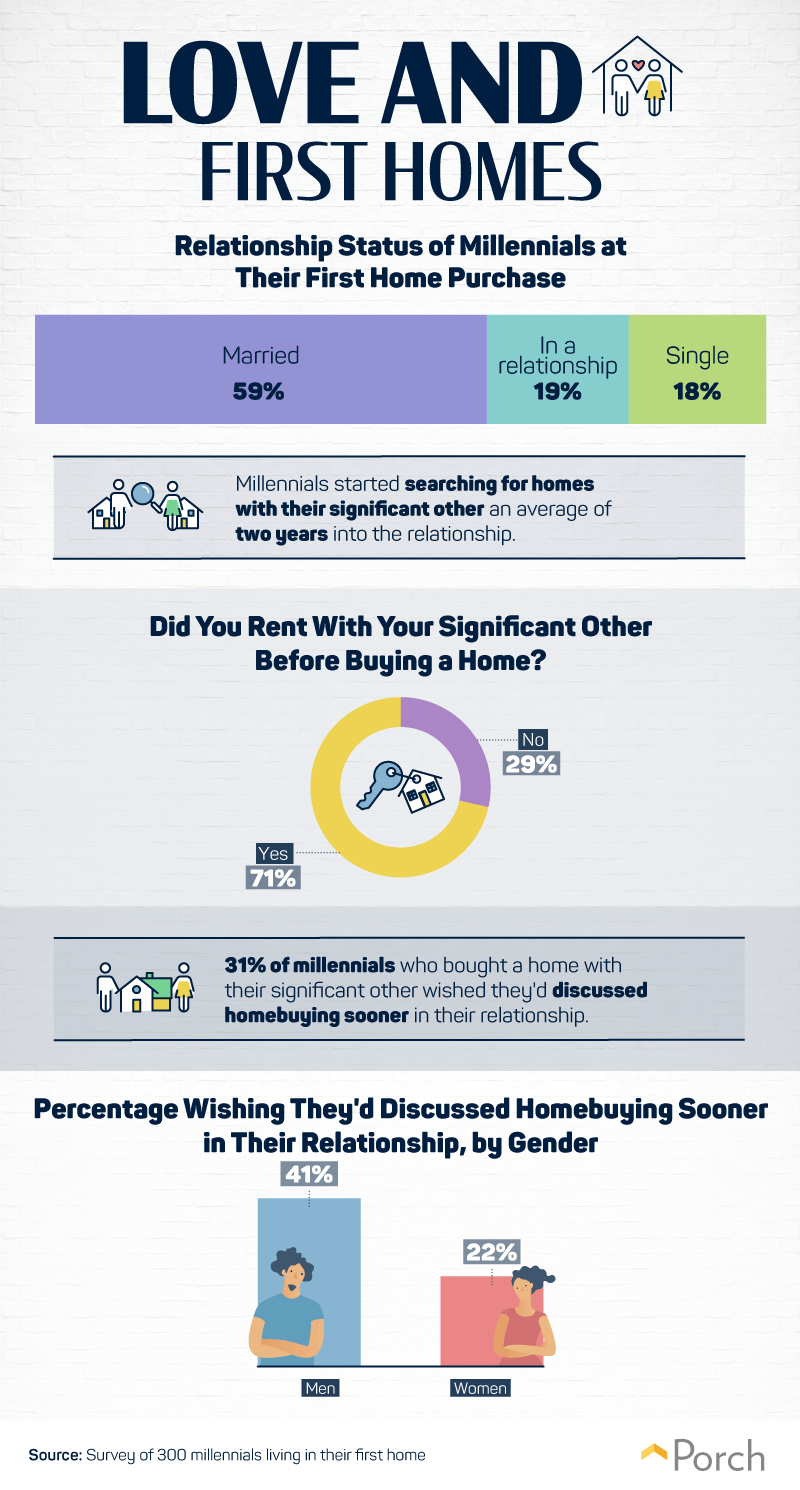

For millennials who are looking to buy a home with a significant other, the road to homeownership should begin with a conversation about goals and expectations. Thirty-one percent of millennials said they wish they had spoken to their significant other sooner when it came to home ownership. Men (41 percent) were more likely than women (22 percent) to wish they had brought it up sooner.

making the right financial decisions

Everyone dreams of their ideal home. Some may even visit listing sites for opportunistic browsing. However, daydreaming can do more harm than good if acted upon. In fact, nearly one in five millennials admitted that they had searched for homes that were financially out of their reach.

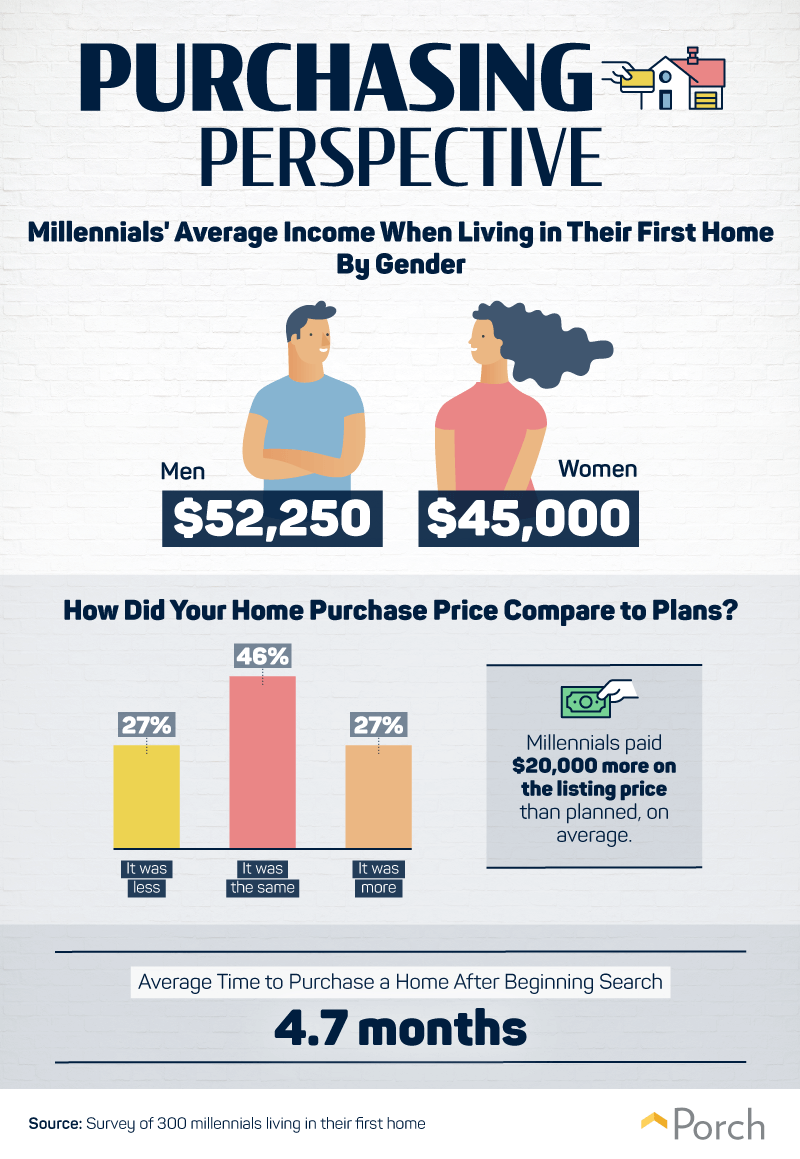

So, what price range were they really looking to be in? The median listing price for millennials they said they would agree to for their first home was $230,239. Although there is currently a strong job market and low-interest mortgages available, first-time home buyers should do their best to make a good decision. More than one in four millennials ended up paying more than expected for their first home: an average of $20,000 more than the listing price.

Connected: Good news for home buyers: Data shows 49% reduction in home loan denials

there is hope

Despite the financial difficulties millennials currently face, many are still hopeful. Nearly 20 per cent of the people surveyed admitted that they are actively looking for housing options despite being financially unable to. Nearly a third of Millennials also attended open houses for fun. A majority (77 percent) said they occasionally house hunt, even though they have no plans to buy.

While buying a home can be a bit overwhelming, staying optimistic and setting realistic goals are simple steps first-time buyers can take to make sure they stay on track. The buying process takes about five months on average, so there’s no need to rush into anything.

are you a millennial? Are you shopping for a home? Are you a seasoned homebuyer? What advice do you have for the younger generation?

Join the conversation in the comments section below.

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.