Another day, another contradictory economic data point. For the past several months, the US economy has been sending confusing and often conflicting signals about what’s to come. Some indicators show the US economy is doing relatively well, while others are showing ominous signs of a recession. So which one is it? Is America Heading For A Recession In 2023, Or Could The Federal Reserve Really Be Aiming For A “Soft Landing”?

For most of the past year, I’ve been firmly in the “there will be a recession” camp, and I haven’t necessarily changed my mind, but some of the better-than-expected economic data are impossible to ignore. Recently released. I’m not saying there will be a soft landing, but I think it’s more likely now than a few months ago. Below, I’ll give the evidence for and against recession, and you can decide for yourself what you think.

recession issue

rising interest rates

Any conversation about a recession must begin with the Fed’s actions to raise interest rates. Since March, the federal funds rate has risen from near zero to nearly 4.5%, in an effort to combat rampant inflation. Rising interest rates make it more expensive to borrow, which can lead to less borrowing, spending, and investing. The economic cooling effects of rising rates can take months, or even years, to kick in, and it’s quite possible that we haven’t fully felt the effects of rate hikes that happened months ago – let alone the fact that that they are still running.

That said, there are already signs that economic activity is slowing. Notably, consumer spending has been slowing for the past two months.

Decline in consumer spending and sentiment

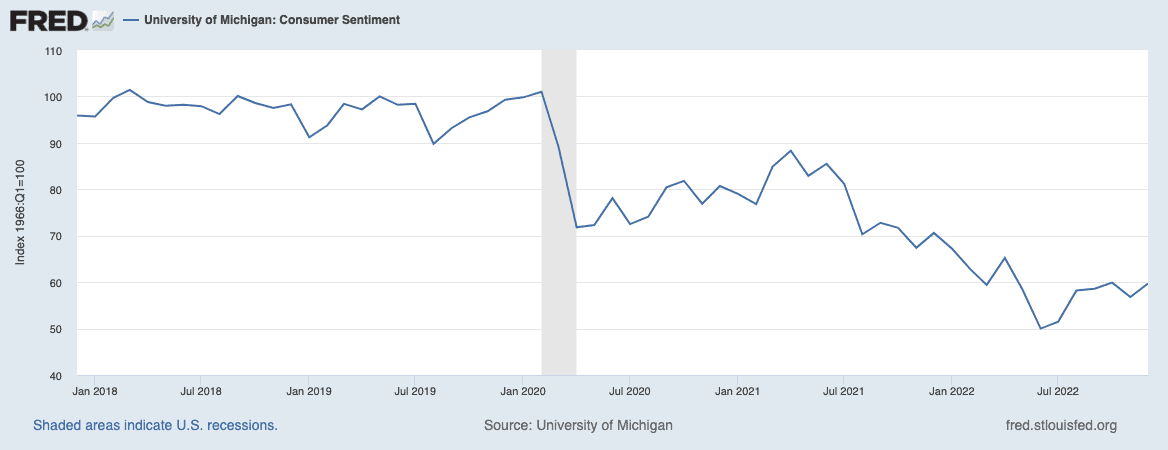

Consumer spending is the engine of the US economy, as it makes up about 70% of the gross domestic product (GDP). After years of high inflation, a bad year for the stock market in 2022, and much economic pessimism, it looks like Americans are cutting back on spending and bracing for tough times ahead.

It is noteworthy that although there has been a slight recovery in consumer sentiment from the summer 2022 low, it is still marginal. This does not appear to mean that consumer spending will pick up any time soon.

a tight labor market

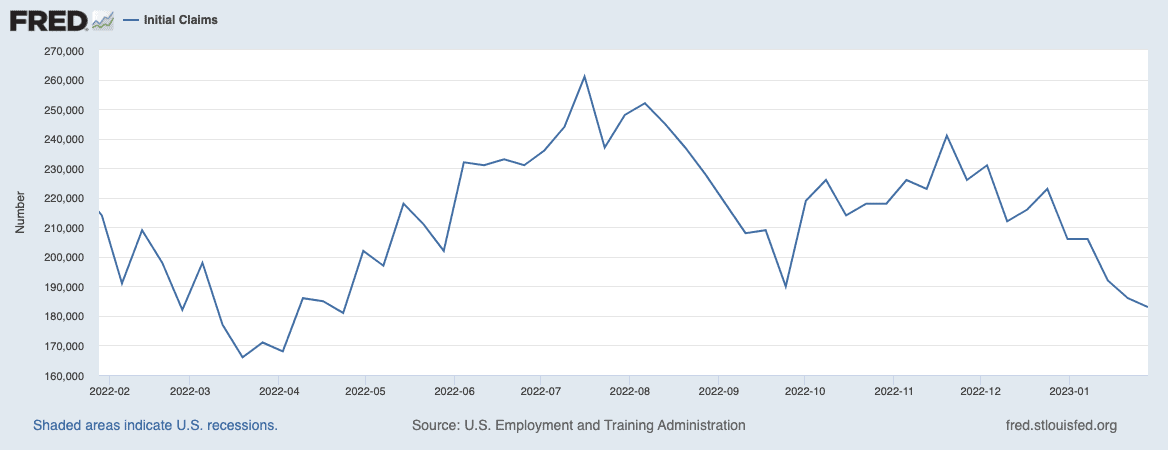

The labor market is an enigma right now, but there have been some big high-profile layoffs in the last several months. The tech sector has been hit particularly hard with companies like Amazon, Microsoft, Google, Netflix, Spotify, and many more laying off large swathes of highly paid employees. We are also seeing layoffs in some financial and professional services sectors.

While these layoffs have not yet affected the unemployment rate, there is a general feeling that this is just the tip of the iceberg, with more layoffs to come. Additionally, there has been a modest increase of late in ongoing unemployment claims (those who have been looking for work for some time), indicating that laid-off workers are taking longer to find a new job. Of course, any significant increase in the unemployment rate would greatly increase the likelihood of a recession.

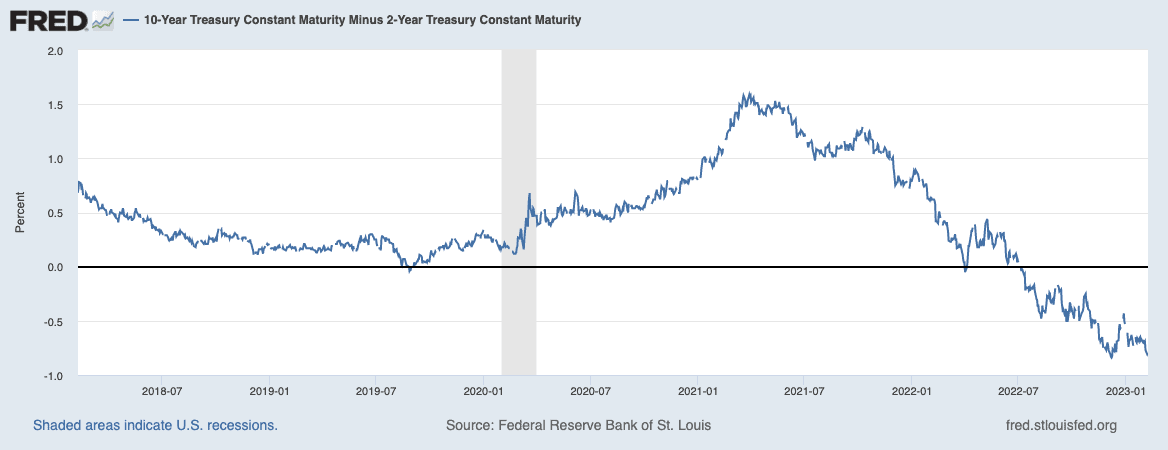

an inverted yield curve

Finally, there’s the yield curve, one of the most reliable predictors of recessions over the last 40 years. It accurately predicted all but one recession during that time. An inverted yield curve occurs when long-dated US Treasury bonds offer a higher yield than short-dated bonds.

This is unusual because longer-dated bonds typically offer higher yields due to higher risks of inflation and default over longer periods. The yield curve is inverted only when investors are betting on a fall in long-term interest rates (due to an economic recession). We all know that the Fed is currently raising interest rates, but the yield curve tells us that investors are betting that there will be a recession and that the Fed will eventually have to cut rates.

There are plenty of other economic signals indicating a recession, but these are the clearest and most reliable datasets we have.

case of soft landing

For months now, the Federal Reserve has been telling us they are targeting and believe a “soft landing” is possible. A soft landing basically means that the economy will cool down enough to reduce inflation but not enough to cause a recession. As I wrote above, I thought this was far-fetched a few months ago, but some data suggests that a soft landing is still possible.

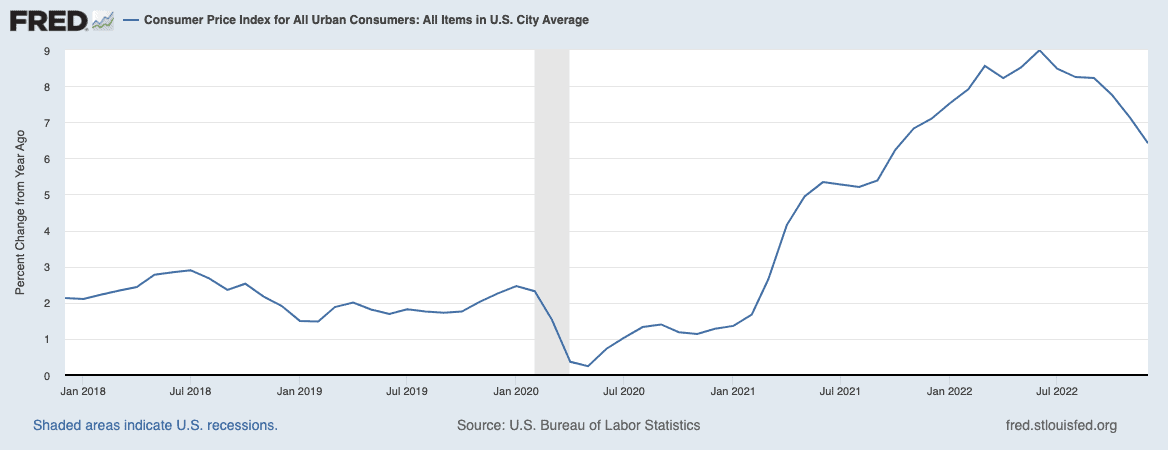

falling inflation

First and foremost, inflation is on the decline, as I’ve written extensively. That’s still very high (last reading at 6.4% year-to-date), but the downward trend is clear, and monthly readings have been very encouraging of late.

Since the primary bearish pressure on the economy is inflation and the Fed’s actions to control inflation, any reduction in the inflation rate is positive news for the economy. If the Fed stops raising rates, it will remove a lot of uncertainty from the economy, which could help stabilize it.

A Confusing But Flexible Labor Market

Another encouraging factor is the labor market. Yes, I know I wrote that the labor market is showing signs of recession, but it is showing signs of resilience all the same. This is very confusing. Despite the high-profile layoffs that are making headlines, there are signs that the labor market is doing pretty well. After rising over the summer, the number of initial jobless claims (people who claim unemployment benefits for the first time) has been declining over the past few weeks.

There are still more than 10.5 million unfilled jobs in America, far outnumbering job seekers. As a result, the unemployment rate remains extremely low at 3.5% (by December 2022). Of course, a bigger question is whether there are open jobs keeping up with job seekers, and as I mentioned above, more layoffs may be around the corner. But any way you look at it, the labor market has shown tremendous resilience so far.

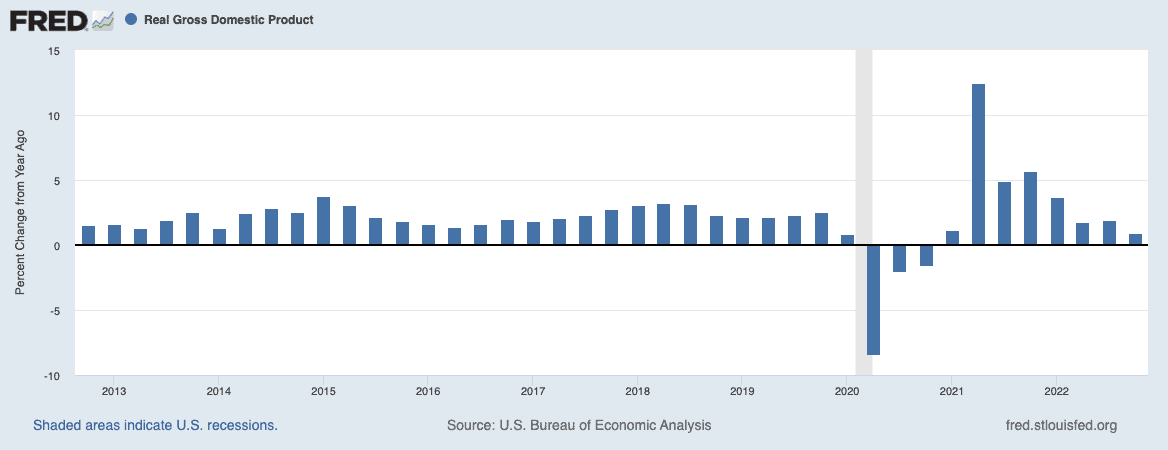

GDP growth

Finally, GDP has been growing in inflation-adjusted terms as well. Real GDP grew at a 2.9% annual rate in Q4, which is basically the antithesis of recession. The most commonly accepted definition of a recession is a decline in GDP for two consecutive quarters (even though this is not technically how a recession is determined). By that measure, America is certainly not in a recession.

It’s worth noting that most economists calling for a recession in 2023 are saying it will come in the second half of the year, so GDP growth in the fourth quarter of 2022 isn’t exactly surprising. That said, in my opinion, GDP growth is a good sign for the economy.

What do the experts say?

Despite some relatively good economic news of late, more than 70% of economists polled still believe a recession will come, according to a Bloomberg poll. Every economist has a different opinion. Still, there is a general consensus among those who believe there will be a recession, we have not yet felt the full effects of higher interest rates. We will see a further decline in consumer spending and higher unemployment through 2023.

That said, even some cynics acknowledge that a soft landing is possible. Jason Draho, an economist and head of asset allocation Americas for UBS Global Wealth Management, recently said, “The prospect of a soft landing is higher than the market believes. Inflation has now come down more sharply than recently expected, and the labor market Made better than expected.”

Mark Zandi of Moody’s Analytics recently coined the term “recession” to describe what he thinks is a slowing of the economy almost to a halt, but without actually slowing down.

What does all this mean?

Of course, no one knows what will happen in the year ahead, but I think it’s increasingly likely that we’ll see a relatively modest outcome – either a soft landing with very little growth or a recession that isn’t very deep. We often like to see things in black and white and say it’s “recession or not,” when in reality, there are many shades of gray.

It is likely that we will land in a shade of grey.

Of course, things may change. There are many geopolitical risks, and if the labor market really breaks down or the stock market goes even lower from here, there could be a deep recession.

For real estate investors, it is important to know that economic downturns tend to come with lower mortgage rates. So while no one should be backing a recession, it’s an interesting dynamic for real estate investors.

It is often said that housing is “first in and first out” in a recession. Because real estate is a highly leveraged asset, during a rising interest rate environment, housing activity tends to slow down first. Housing makes up about 16% of GDP, so when housing slows, it can drag the rest of the economy into recession. Once the economy is in a recession, interest rates tend to fall, making mortgages cheaper and homes more affordable. This could lead to a spurt in buying among homeowners and real estate investors, and a spurt in housing activity could help lift the rest of the economy out of recession. First one in, first one out.

We’re already starting to see it in some ways. Housing has slowed down in the past few months. Mortgage rates are down from November levels, but they could drop further if we see a recession. Combined with falling housing prices, this could create good buying opportunities that could lift the economy out of recession.

Of course, this is just one scenario, but it’s the one I see as most likely at this point.

More from BiggerPockets: The State of 2023 Real Estate Investing Report

After years of phenomenal growth, the housing market has changed course and registered a recovery. now is your time to take advantage, Download the 2023 State of Real Estate Investing Report written by Dave Meyer to learn which strategies and tactics will pay off in 2023.

What do you think will happen in 2023? Do you think we’ll see a soft landing? a recession? or something in between. Let me know in the comments below.

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.