It’s finally over! The crazy, unpredictable and just plain weird housing market of 2022 has come to an end. While analysts like me will study the 2022 housing market for years to come, we can finally take a quick look at what happened this year and anticipate what may be in store for the coming 2023.

2022 was a tale of two parts. through January may June There was one type of market, and from July to December the market was completely different. It is not possible to determine the exact date of the shift, but it was within this time frame.

first half

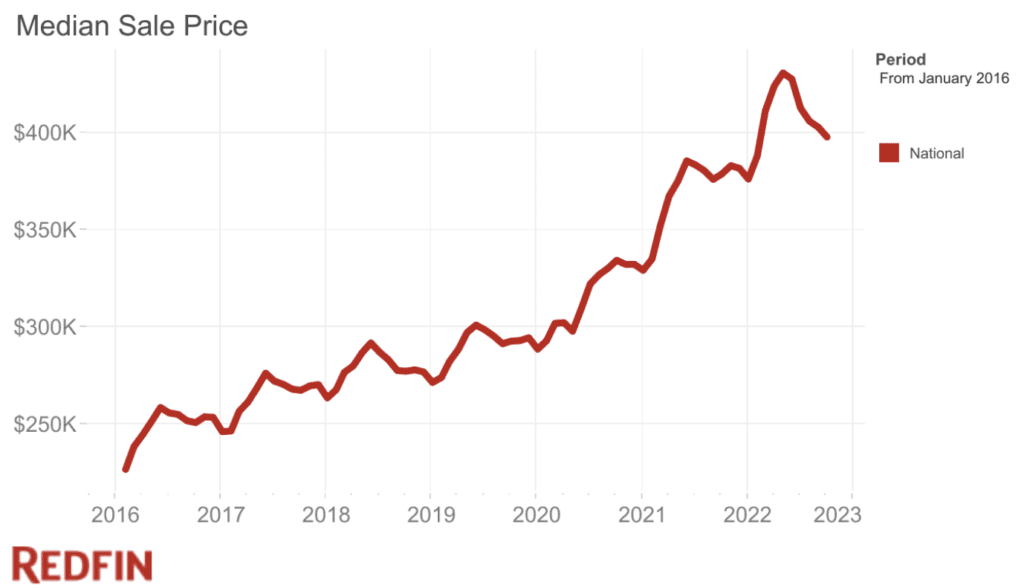

During the first half of 2022, we saw a continuation of the wild appreciation that defined 2021. Every major variable affecting housing prices was putting upward pressure on the market. There was strong demographic demand with Millennials reaching their peak home buying years. A decade of underbuilding contributed to nationwide housing shortage, Goods were almost non-existent. And, of course, mortgage rates were historically low.

But then, things changed. In March of 2022, the Federal Reserve begins raising the federal funds rate, raising bond yields and mortgage rates. The policy change actually increased demand as homebuyers and sellers rushed to transact before the full effects of higher mortgage rates were felt. This, combined with normal weather, allowed the party to continue and prices to continue to rise for a few additional months.

Second quarter

Eventually, the effects of skyrocketing mortgage rates took hold. Already facing ultra-high home prices, high mortgage rates drove many home buyers out of the market, and demand fell. When demand falls, inventory tends to rise, which is exactly what happened.

As inventory increased, the leverage of sellers who had been intoxicated with power over the years began to wane. Gradually, buyers began to have more choice, and a bit of equilibrium returned to the market, pushing prices down.

Some of the decline since June has been seasonal, but as of December 2022, prices are down about 10% from their May peak, and a typical seasonal decline is 5%–7%. The drawdown from the summer peak was deeper in 2022.

It is worth noting that although prices are falling, they are not in free fall. Prices continue to rise year-on-year, and inventory is starting to dwindle. Mortgage rates decreased from October to December, and there are signs that the drop-off is becoming less rapid. At this point, we remain in a correction, but do not crash.

What will happen in 2023?

Will we continue the downtrend we are in now? Will things get worse? Or could the market reverse?

For me it will again be a story of two parts. I believe that in the first half of 2023, we will see a continuation of the market we are in now: sellers don’t want to sell, and buyers don’t want to buy. Of course, the deals are still ongoing, but I expect the sales volume to remain much lower than the last 7-10 years. Even though inflation is coming down, there remains too much uncertainty in the economy for the market to stabilize completely.

Hopefully, during the first half of 2023, we will see inflation come down and get more clarity on what is happening with the global economy. But what really matters when it comes to housing quantity and home prices is one thing: affordability. If housing remains as unaffordable as it is now, sales volume and appreciation will remain low. If affordability recovers, I expect the housing market to stabilize and perhaps even see a modest recovery in the second half of 2023.

It sounds overly simple, but housing is very unaffordable in current market conditions. Some estimates say housing is the least affordable it has been in the last 40 years. Until this changes, housing reform will remain on hold. The housing shortage and demographic demand haven’t gone anywhere. As affordability improves, I expect housing market activity to resume.

Will there be an improvement in potency?

Potency is made up of three factors:

- real wages

- House prices

- mortgage rates

Affordability may improve if wages rise or home prices and/or mortgage rates fall. Let’s see if any of these can happen.

real wages

According to the Bureau of Labor Statistics, Real (inflation-adjusted) wages are down about 2% year-over-year, but have risen about 0.5% since September. Nominal (not inflation-adjusted) wages are indeed very high, but inflation is very high and wipes out all those gains.

| actual earnings | November 2021 | September 2022 | October 2022 | November 2022 |

|---|---|---|---|---|

| actual average hourly earnings | $11.21 | $10.95 | $10.95 | $11.00 |

| real average weekly earnings | $390.20 | $377.71 | $377.80 | $378.42 |

While it is a positive sign that real wages have increased slightly, it is very modest. It is possible that, as inflation declines, real wages will increase—but I find it unlikely that this will happen in a meaningful way. For me, the worry about a slowing economy will slow the pace of wage growth with inflation. Therefore, no real progress will be made on real wages.

housing prices

One area where affordability is likely to improve is home prices. Residential real estate prices will see a year-on-year decline nationally, making homes more affordable. For affordability to really improve, we’d probably need to see prices fall by more than 10%, and it’s very unclear whether that will happen. If prices fall at all and by how little, it will depend largely on mortgage rates.

mortgage rates

Mortgage rates can be confusing, especially lately. The Fed has continued to raise the federal funds rate and has indicated that they will continue to do so in 2023. Yet, mortgage rates are declining. What’s going on here?

Mortgage rates are not directly tied to the federal funds rate. Instead, it is very closely tied to the yield on the 10-year Treasury. So, in a way, mortgage rates are more influenced by bond investors than by the Fed (although bond investors are highly influenced by the Fed. It’s confusing, I know).

Bond yields have fallen over the past several weeks for two reasons. First, inflation is coming down more quickly than expected, which causes a rally in bonds, which lowers bond yields.

Second, there is the possibility of a global recession. These fears prompt global investors to seek safety US Treasury Bonds, which pushes bond prices up and bond yields down. When bond yields fall, mortgage rates fall, which is exactly what we’re seeing. So, mortgage rates may fall next year and ends somewhere between 5.5% and 6.5% in October 2022, down from the most recent peak of 7.23%.

conclusion

If I predict 2023 housing market affordability, there are two plausible outcomes for the second half of 2023.

First, mortgage rates decline modestly (under 10%) in conjunction with increasing affordability during the second half of 2023. This will likely lead to a decline in the housing market in the first quarter of 2024, and we will start to see market growth again come early 2024.

The other option is no affordability improvement in 2023, probably due to continued high inflation and mortgage rates. If this happens, the second half of 2023 will look a lot like the first half of 2023, and we can expect a longer correction. In this scenario, we will probably see a 10-20% drop in housing prices over the next two years, and we will not see the market decline until late 2024/early 2025.

Given the amount of economic uncertainty, it’s hard to know what will happen. As of this writing, I think the first scenario is more likely given recent trends in inflation and bond yields. But both options are reasonably likely at this point. Unfortunately, the next twelve months will be cloudy.

What do you think will happen in 2023? Let me know in the comments below.

On the Market is offered by Fundrise

Fundraise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investment platform.

Learn more about Fundraise

Note by BiggerPockets: These are the views expressed by the author and do not necessarily represent the views of BigPockets.